Spanish Leads: Insurance Sales Success

When it comes to Spanish Leads, many insurance agents and brokers are missing out on a significant market opportunity.

The lack of understanding or resources in the Spanish language can create barriers that prevent this segment from obtaining adequate coverage.

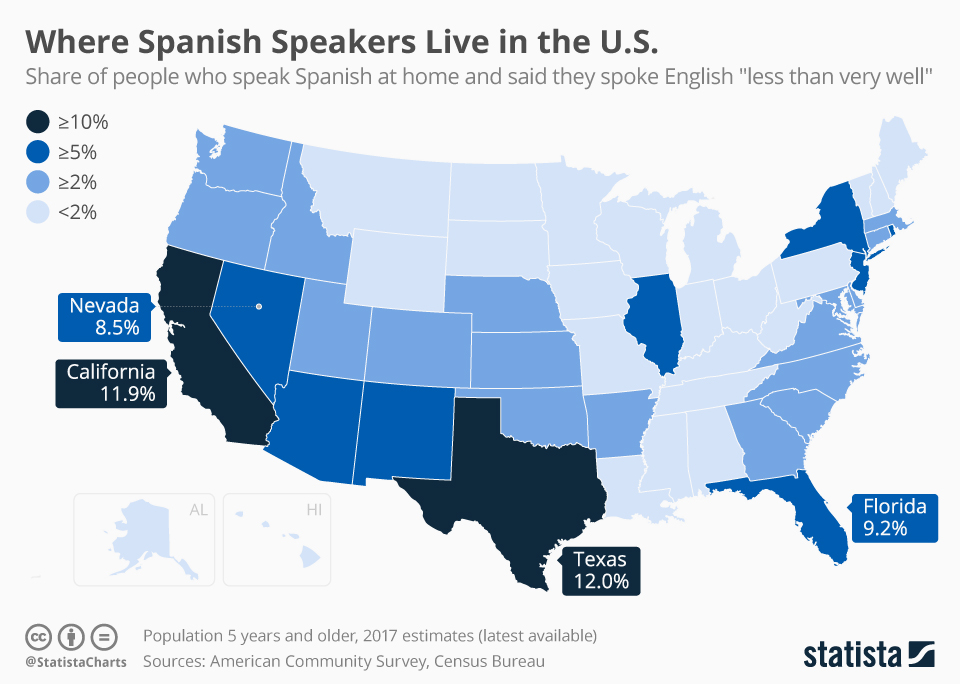

According to U.S. Census Bureau, over 41 million people speak Spanish at home in the U.S., representing a large pool of potential clients for your business.

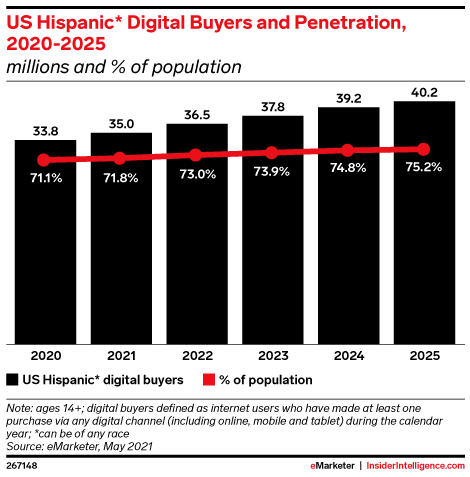

Buying power is also in growth mode for the Hispanic market.

If you’re serious about tapping into these valuable Spanish Leads, it’s essential to be strategic with your approach – from hiring bilingual agents to providing resources in their native language.

This isn’t just about translation; it’s about cultural sensitivity and understanding the unique needs of this demographic group within the insurance industry.

In this post, we’ll provide insights on how you can effectively engage with and serve this growing market segment, ensuring they get high-quality service while helping your agency grow its customer base and revenue streams.

Ready? Let’s dive right in…

Understanding the Spanish-Speaking Insurance Market

Insurance agents have a great opportunity to tap into the Spanish-speaking population in the US, with their estimated $1.5 trillion purchasing power poised to drive growth in the insurance sector. With over $1.5 trillion in purchasing power, this community is set to drive growth in the insurance sector.

Where do they live? See image from Statista.

Insights from Conning Research and National Association of Hispanic Real Estate Professionals

A study by Conning Research predicts an increase in Hispanic drivers and homeowners, making them potential customers you can’t afford to ignore.

The Importance of Cultural Sensitivity

Cultural sensitivity isn’t just nice-to-have; it’s a must-have when dealing with diverse communities like Hispanics. Understanding their unique needs will help tailor your marketing efforts effectively.

Providing Resources In Spanish

You don’t want language barriers leading to misunderstandings when advising clients about their needs. Having key words, definitions, and other information readily available in Spanish could help mitigate such issues while enhancing customer experience.

List of Keywords & Definitions

Create a list of key terms used during consultations or negotiations translated into Spanish – it’ll be your secret weapon against miscommunication.

Explaining Claims Process

Navigating through the claims process can be tricky even without a language barrier. Make sure you have resources explaining the claims process step-by-step clearly – all written down en Espanol.

Hiring Bilingual Agents

To effectively serve Spanish-speaking communities, bilingual agents are essential. Not just Google Translate wizards, but real-deal bilingual professionals.

Why? Because communication is king in insurance, and language barriers can be a royal pain.

We recommend using a website like Indeed to find quality bi-lingual agents for your brokerage.

The Importance of Cultural Sensitivity

Cultural sensitivity isn’t just about averting missteps; it’s about comprehending what customers need on a more profound level. Remember, not all Hispanic cultures are identical – there’s diversity within diversity.

A Pew Research study shows that U.S Hispanics come from 20 different origins. Catering to this rich tapestry requires more than basic translation skills.

Here’s a sample Spanish script that we provide for free.

Catering Marketing Efforts According to Audience Demographics

Your marketing efforts should reflect the unique characteristics of your audience demographics. This means crafting culturally relevant messages and using channels preferred by these communities.

Serving Up Some Spanish on Your Website and Social Media Channels

If you want your agency to appeal directly to this demographic, then why not serve up some Spanish on your website? Consider creating landing pages specifically designed for these customers with all information presented in Spanish.

You can also translate your website very easily especially if you have built your site on the WordPress CMS. We actually use a language tool called Weglot. After trying many different tools over the years, we’ve found this to be one of the best.

Beyond the Language: Understanding Cultural Nuances

In addition to providing resources in their language, it’s also crucial that we understand cultural nuances within the Hispanic community. For instance, family values are often central among Hispanics, so incorporating messaging around protecting loved ones through adequate coverage might resonate well with them. This isn’t just about speaking their language – it’s about speaking to them.

Recommending Higher Coverage Options

The Spanish-speaking community often overlooks the importance of insurance, viewing it as a necessary evil rather than an investment in their future. Your mission, should you choose to accept it, is to change this mindset and highlight the benefits of higher coverage options.

Encouraging Life Insurance Adoption Among Hispanics

Life insurance is not just for old folks anymore. Show your clients how life insurance can provide financial security for their families, pay off debts, or even fund a child’s education. Use real-world examples that resonate with them.

For instance, talk about Juan, who was able to send his daughter to college thanks to his life insurance policy payout after he passed away unexpectedly.

Cross-selling Opportunities

You’ve got them hooked on life insurance; now reel them in with other products. This calls for a subtle approach, one that necessitates an appreciation of the customer’s wants and needs.

Selling Auto Insurance:

- Talk about Carlos, whose car was totaled but didn’t have enough coverage to replace it. Don’t let your clients be like Carlos. Offer comprehensive auto policies that cover more than just liability.

Selling Homeowners Insurance:

- Discuss Maria, who lost her home in a fire but had insufficient homeowners’ coverage. Encourage clients not only to purchase basic dwelling protection but also to consider additional living expenses (ALE) coverage, which pays extra costs if they have to live elsewhere while repairs are being made.

Remember, your goal isn’t simply selling more policies; it’s providing peace of mind and securing futures.

Enhancing Customer Retention Through Quality Service

The Hispanic community, historically underserved, has a soft spot for quality service. Show them you care and they’ll stick around. Spanish leads can be a valuable asset for insurance agents and brokers looking to improve their customer retention rates.

Independent agents, this is your time to shine. Your mission, should you choose to accept it, is to provide top-notch service consistently. No pressure, but the fate of your agency’s retention rates rests in your hands.

Role Of Independent Agents In Ensuring Continuous Coverage

Become their go-to insurance guru. Make sure they know that you’re not just there when it’s time for renewal or when disaster strikes – be proactive with check-ins and updates on policy changes.

You see, Spanish-speaking customers appreciate high-quality service so much that they’re less likely to rate shop at renewal time if provided with excellent service initially. So don’t drop the ball after making the sale; keep those juggling skills sharp.

Avoid Common Pitfalls That Drive Customers Away

- Poor communication? No bueno. Keep lines open and clear – remember language barriers can cause misunderstandings.

- Inadequate coverage explanations? Not on our watch. Educate clients about their policies thoroughly.

- Lackluster response times? No one has the time for that. Be prompt in addressing concerns or queries.

Maintain Consistent Contact With Your Clients

- Schedule regular check-in calls – make them feel valued.

- Email newsletters with relevant content – educate while keeping your brand top-of-mind.

- Social media engagement – interact beyond business hours.

The key here is consistency. Don’t let all these efforts fizzle out after a few weeks. Remember: You’re building relationships here. And good relationships take effort… consistent effort.

So get out there and show ’em what real customer service looks like.

Leveraging Referrals For Growth

Hispanic communities are like a tightly-knit quilt. Win one, win all.

Let’s break down how you can tap into this goldmine:

Hosting Culture-Centric Events

Create the vibe, attract the tribe. Culture-centric events resonate with Hispanic audiences. They feel valued and understood. A simple community event or even an online webinar about insurance basics in Spanish could do wonders.

The Power of Word-of-Mouth Marketing

Your satisfied customers become your walking billboards. Word-of-mouth promotion is a highly influential force in tightknit communities. A good experience gets talked about at family dinners and neighborhood gatherings.

Making Referral Programs Irresistible

You’ve got to give some to get some. Offering attractive referral programs can be a game-changer here.

Tips for Successful Referral Programs:

- Best practices for referral programs

- Promote it well: Use social media channels and email newsletters

- Reward both parties: The referrer and referee should both benefit from the program

- Simplify it: Make sure your referral process is easy to understand and execute. No one likes complications.

Bonus Tip:

This approach not only helps in gaining new customers but also strengthens relationships with existing ones. Remember, every customer interaction leaves an impression – make it count.

Conclusion

Targeting Spanish Leads: Tips for Insurance Companies

- Understand the market and culture to effectively cater to your audience.

- Hire bilingual agents who are culturally sensitive to assist with marketing efforts.

- Provide resources in Spanish such as key words and definitions, and explain claims process to better serve Spanish-speaking customers.

- Recommend higher coverage options like life insurance adoption among Hispanics to increase cross-selling opportunities.

- Enhance customer retention through quality service, especially with the role of independent agents in ensuring continuous coverage.

- Leverage referrals for growth by hosting culture-centric events to expand your reach within the Spanish-speaking community.

By implementing these tips, insurance companies can effectively target and serve the Spanish-speaking market.