![Best Insurance Lead Companies: A Guide For Agents [Updated 2024]](https://badassinsuranceleads.com/wp-content/uploads/2023/06/2023-06-28_14-31-01.png)

Best Insurance Lead Companies: A Guide for Agents [Updated 2024]

TL:DR;

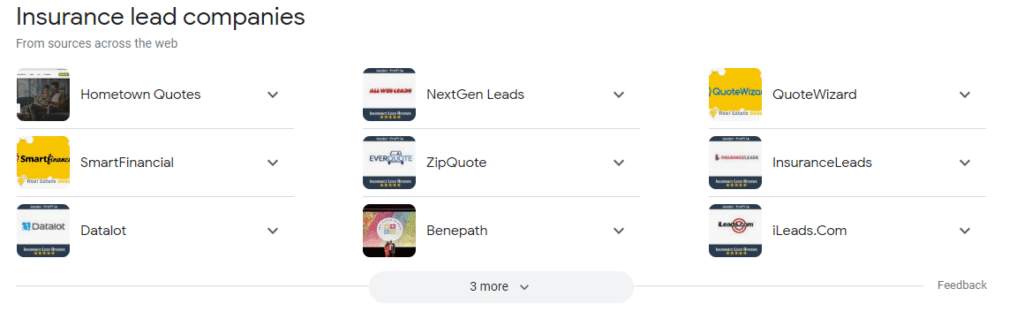

Choosing the right insurance lead vendor is crucial for agency growth. We reviewed five top companies based on reviews, agent feedback, and internal testing:

- SmartFinancial: Tech-driven, flexible pricing, control over leads.

- Datalot: Pre-qualified live calls, pay-as-you-go, no contracts.

- QuoteWizard: High-volume leads, customizable filters.

- Hometown Quotes: Real-time leads, strong customer support.

- EverQuote: Focus on auto/life leads, offers warm transfers.

When it comes to finding the best insurance lead companies, there’s a lot of noise out there for your typical life insurance leads agent and broker.

You’ve probably heard countless suggestions and read numerous reviews on lead vendors.

But here’s an undeniable fact: Not all insurance lead generation companies are created equal.

To be successful in your insurance business, you need quality leads from reliable sources.

How did we find these companies? We’ve scoured the internet for reviews, polled insurance agents and even tried out all 5 of the insurance lead vendors below. (More info towards the bottom of the post on how we rated and why we picked them). See an easy to understand comparison table below of the different insurance lead companies:

More Details on Our Top Insurance Lead Companies (in no particular order)

Let’s dive in.

SmartFinancial

SmartFinancial is a well-regarded insurance lead generation company that specializes in providing leads across multiple insurance product lines. Their offerings include live call transfers, exclusive web leads, and real-time shared web leads, catering to a range of insurance products such as auto, home, health, and medicare.

Here’s a summary and some key points that would be useful for an insurance agent considering Smart Financial:

Who is Smart Financial?

- Founded by Insurance Veterans: Established by experienced individuals in the insurance industry, ensuring an in-depth understanding of the sector’s needs.

- Diverse Lead Products: Offers a variety of lead types, including live call transfers and exclusive and shared web leads.

- Technology-Driven Approach: Utilizes technology to target specific client demographics, enhancing the quality of leads.

Key Points for Insurance Agents:

- Quality and Variety of Leads: Smart Financial provides high-quality leads generated from high-intent traffic sources. They offer leads in different formats like live call transfers, exclusive web leads, and shared web leads, ensuring a range to choose from based on your specific needs.

- Customization and Control: Agents have control over lead volume, campaign pausing, and scheduling, and can customize lead types with various geographic and field filtering options. This level of control allows for a more targeted and efficient lead generation process.

- Competitive Pricing and No Contracts: Their leads are competitively priced with options suitable for different budgets. They do not require long-term contracts, offering flexibility and ease for agents.

- Generous Return Policy for Bad Leads: Offers a two-week return window for leads with bad data, ensuring that agents are not paying for unusable leads.

- National Coverage and Extensive Data Fields: Smart Financial provides leads across the United States, with over 35 data fields collected for more detailed and specific leads.

In summary, Smart Financial offers a comprehensive and flexible lead generation service that could be highly beneficial for insurance agents looking to expand their client base. The company’s experience in the insurance sector, coupled with its technology-driven approach and customer-friendly policies, makes it a strong contender in the insurance lead generation market.

Datalot

Datalot is a unique player in the insurance lead generation market, specializing in delivering pre-qualified live call leads directly to insurance agents. Established in 2009, Datalot offers a product that differs from traditional shared leads, focusing solely on providing incoming calls, which are exclusive and pre-qualified.

Who is Datalot?

- Founded by Communications Software Developer: Datalot was established by Josh Reznick in 2009 to simplify online lead generation, specifically for the insurance industry.

- DialDrive Platform: Utilizes its DialDrive platform to automate the web-to-phone sales process, offering live leads on demand.

- Targeted Lead Generation: Digital marketers at Datalot source prospects online, qualify them over the phone, and then match them with insurance sales agents.

- Product Lines: Offers a comprehensive range of insurance product lines, including auto, home and renters, health, Medicare, commercial, and more.

Key Points for Insurance Agents:

- Customization and Control: Agents can customize the types of leads they receive, including the geographical location and specific criteria like insurance history or accident history. The system allows for control over the number of calls received and their timing.

- Pricing and Payment Model: The cost of Datalot calls varies based on the product line and the filters applied. Pricing typically ranges from $20 to $60 or more per call, depending on these factors. Datalot operates on a pay-as-you-go model with no contracts, offering refunds if a consumer does not meet the pre-set filter criteria.

- Mixed Reviews: While Datalot’s platform is noted for its intuitiveness and ease of use, and the company provides dedicated account managers, there have been mixed reviews regarding the cost of leads and the effectiveness of the filtering system. Some agents have reported receiving calls from consumers outside their pre-selected filters, and there have been challenges in obtaining refunds for these leads.

- Unique Selling Proposition: One of Datalot’s key selling points is the direct incoming calls to agents, which are exclusive and pre-qualified. This approach is designed to save agents time and effort in contacting leads, with all calls being recorded for playback and training purposes.

In conclusion, Datalot presents a distinct approach to insurance lead generation through its focus on live call transfers. While it offers several advantages in terms of lead quality and customization, potential clients should also consider the feedback regarding pricing and lead relevance when deciding if Datalot is the right choice for their needs

QuoteWizard

QuoteWizard stands out in the insurance lead generation market with a strong emphasis on providing quality leads for a variety of insurance lines, including Auto, Home, Health, Medicare, and Renters insurance. Founded in 2001, it has established itself as one of the largest privately-held, independent insurance lead companies in the United States.

Who is QuoteWizard?

- High-Volume Lead Generation: Generates over 300,000 unique insurance leads monthly, servicing a nationwide network of more than 7,000 agents.

- Quality Focused: Utilizes a lead scoring system, QuoteWizardIQ, to monitor and enhance the quality of leads. This has resulted in significant improvements in lead quality and agent satisfaction.

- Versatile Lead Offerings: Provides leads across multiple lines, including auto, home, renters, condo, health/Medicare Supplement, and warm transfers.

Key Points for Insurance Agents:

- Customization and Flexibility: Agents have control over the volume and scheduling of leads, with options like daily caps and significant vacation time. This flexibility allows for effective campaign management.

- Competitive Pricing: QuoteWizard offers competitive pricing across various insurance lines, with prices varying based on the type and filters applied to the leads. Discounts and promotional offers, such as up to $500 in bonus leads for new agents, are also available.

- Lead Quality and Filters: The company employs over 60 custom filters, allowing agents to target specific consumer demographics, such as age, prior coverage, marital status, credit rating, and more. This helps in acquiring more relevant and potentially profitable leads.

- Customer Support and Return Policy: QuoteWizard emphasizes customer service, offering easy account changes and a responsive support line. Additionally, their return policy is notably agent-friendly, allowing returns of up to 25% of leads without penalty.

- Recognition and Awards: QuoteWizard has received numerous awards and has been recognized for its rapid growth and value as a lead provider.

- Lead Delivery and Integration: Leads can be delivered through various methods including email, text, CRM integration, and warm transfers for auto and home insurance leads.

In conclusion, QuoteWizard’s combination of volume, quality focus, and agent-friendly features makes it a strong option for insurance agents looking to purchase leads. The company’s comprehensive approach to lead generation, along with its continuous innovation in lead quality and agent support, positions it favorably in the competitive insurance lead market.

Hometown Quotes

Who is Hometown Quotes?

Hometown Quotes, established in 2003, is recognized for its high-quality leads and agent-centric customer service. This focus stems from the company’s founder, Bob Klee, who has extensive experience as an insurance agent and agency owner.

Key Features for Insurance Agents:

- Lead Types and Quality: Specializes in providing real-time leads for Auto, Home, Renters, and Life insurance. The leads are TCPA compliant, not recycled, and distributed to a maximum of 4 agents on average, ensuring higher quality and exclusivity.

- Customer Service and Support: Known for excellent customer service, Hometown Quotes assigns dedicated Regional Directors (RDs) for each agent. These RDs are experienced in insurance and lead industry, offering personalized support.

- Customization and Control: Provides various options for controlling and filtering leads, including volume controls, pausing leads, and applying over 45 custom filters at no extra charge.

- Lead Delivery Options: Leads are delivered through multiple channels including text, email, and lead management systems (LMS/CRM).

- Pricing and Promotions: Offers a competitive pricing structure. Currently, there’s a promotion offering a 50% match on up to $500 of deposited funds for new customers. For specific pricing, agents need to contact the company directly.

- Educational Resources: The company has developed Hometown University, a community providing insurance agents with resources and tips for working with online leads more effectively.

- Integration with Captive Vendor Programs: Integrated with several captive vendor programs and popular lead management systems, facilitating easy management of purchased leads.

- Return Policy: Features a 7-day window for lead returns, which is supportive of agent needs.

Summary:

Hometown Quotes is a reputable choice for insurance agents seeking quality leads with a personalized touch. The company’s focus on delivering high-quality, non-aged leads, combined with excellent customer service and robust agent support, makes it a valuable resource for agents looking to grow their client base. Its agent-friendly policies, such as no additional charges for filters and a flexible return policy, further enhance its appeal in the competitive insurance lead market.

For more detailed information and to access their current promotions, you can contact Hometown Quotes directly at 720-709-2079

EverQuote

Who is EverQuote?

EverQuote is known for specializing in high-quality insurance consumer leads, focusing on high-intent clients in the auto and life insurance markets. Established as a major player in the U.S. auto insurance marketplace, EverQuote attracts over 5 million unique shoppers each month, delivering leads directly to agents.

Key Features of EverQuote:

- Lead Generation and Delivery: EverQuote sources leads through its own properties and verified partner networks, delivering them in real-time as soon as the prospect’s validity is verified. These leads are generated exclusively for EverQuote and are not resold on other platforms.

- Types of Leads: EverQuote offers a range of lead types including Auto Data Leads, Home Data Leads, Life Data Leads, and Warm Transfer Calls for Auto, Home, and Life insurance.

- Customization and Control: Agents can customize their lead reception based on ZIP code targeting and set daily lead caps to match their business’s capacity. EverQuote provides options for exclusive leads and shared leads, which are shared with a maximum of 3 agents and only 1 per insurance carrier.

- Pricing: The cost of EverQuote leads varies depending on the source’s qualifications and eligibility for subsidy programs. Agents interested in specific pricing details should contact EverQuote directly.

- Agent Resources: EverQuote also offers agent resources, including a book on hiring successful producers, a social media playbook, and various educational materials.

- Customer Feedback: EverQuote has mixed reviews, with some highlighting the quality and exclusivity of the leads, while others express concerns about the number of calls received after filling out forms and the overall quality of leads.

- Lead Return Policy: EverQuote provides a 15-day window for one-click lead return options.

- Lead Distribution and Sharing: Leads are shared with a maximum of 3 agents, ensuring reduced competition among agents for the same leads.

Considerations for Agents:

- Exclusivity of Leads: It’s important to specify the need for exclusive leads as EverQuote also offers shared leads.

- Customization Options: Agents have the ability to tailor the lead acquisition process to their specific needs and capacities.

- Customer Experience: Potential users should be aware of the mixed customer feedback, especially regarding the volume of calls and texts received after using the service.

For insurance agents looking to expand their clientele, EverQuote offers a comprehensive and customizable solution. However, it’s crucial to consider both the benefits and the potential concerns raised in user reviews to ensure it aligns with your specific needs and expectations

Key Questions to Ask Before Choosing an Insurance Lead Company

If you’re an insurance agent or broker looking to buy insurance leads, you may be wondering which company to choose. Fear not. Here’s a roadmap to help you make that crucial decision.

Are you a lead aggregator or generator?

First things first: figure out whether the company is a lead aggregator or generator. A lead aggregator buys leads from other aggregators or generators, while a lead generator sources all their own leads. It’s important to know what you’re buying into.

Do you resell or recycle your leads?

The next stop on our journey is recycling, and no, we aren’t talking about plastic bottles here. Some companies recycle old leads information – make sure yours doesn’t, unless it’s part of your strategy for aged insurance leads.

What kind of incentives are there?

Moving right along, let’s talk incentives. Companies use various methods to gather lead info; some might offer free quotes while others may promise exclusive deals. Make sure their approach aligns with your business values and customer expectations.

Evaluating Their Level of Customer Service

Last but definitely not least:

Your potential partner should have stellar customer service – remember, this isn’t just about purchasing lists of names, it’s about building relationships that will help grow your business faster.

Understanding What Makes Insurance Leads Companies Good or Bad

Let’s cut to the chase: not all leads are created equal. And neither are insurance lead companies. If you’re an insurance agent or broker wanting to expand your business, it’s important to understand what attributes to look for.

The Anatomy of a Good Insurance Lead Company

A top-notch insurance lead company doesn’t just sell leads; they provide high-quality, originally sourced leads that can help you acquire new customers and grow your business faster. They don’t just hand over a list of names – they offer guidance on building effective strategies around those resources.

Differentiating Between Aggregators and Generators

In the world of insurance lead companies, there are two main players: aggregators and generators. Understanding the difference between them is key in choosing where to purchase your leads from.

- Lead aggregators: These companies buy up large quantities of leads from other aggregators or directly from generators before selling them off again (think middlemen).

- Lead generators: These companies source most or all of their own fresh-as-a-daisy leads through various marketing channels such as online advertising, direct mail campaigns, etc.

Your success with purchasing insurance leads isn’t set in stone – it’s something that should be revisited regularly based on how successful you become at converting these prospects into clients. A reputable provider will allow flexibility when it comes to adjusting the number of purchased contacts according to your evolving needs and successes. Remember this golden rule: always keep track and adjust accordingly.

You’ve done some homework now on understanding different types of providers out there along with identifying key factors while selecting one. The next step? Dive deeper into evaluating specific option

Evaluating Potential Growth with an Insurance Lead Company

Now that we’ve covered the key questions to ask, let’s shift gears to evaluating potential growth.

Variety of Service Packages Offered by the Vendor

- Finding the perfect fit: Look at the variety of packages offered by vendors – can they cater to both small-scale needs as well as large volume requirements?

Potential for Scaling as per Business Growth & Flexibility in Account Management

- Aiming higher: Can these providers scale up services according to your agency’s growth trajectory? Do they allow flexibility in managing accounts so you can revisit purchased quantities based on success rates?

Dedicated Account Manager and Cancellation Policies

- The finer details: Does the vendor provide dedicated account management support? What are their cancellation policies like? Considering these nuances could be pivotal in forming lasting associations.

By asking these key questions and evaluating potential growth, you’ll be well on your way to choosing the best insurance lead company for your needs.

When it comes to choosing an insurance lead generator, you’re not just buying leads. You’re investing in the potential growth of your agency.

Flexibility and Scalability Options for Purchasing Leads

You need a partner that can scale with you as your business grows. That means flexibility in purchasing options and scalability for future expansion.

Ask about their packages: Can they handle small orders for startups? What about bulk orders for established agencies?

If they have rigid structures or lack scalability, it might be time to bounce like a bad check.

Variety of Service Packages Offered by the Vendor

Diversity is key here – both in terms of services offered and pricing models. Do they offer real-time leads, aged leads, exclusive or shared ones?

The more variety on offer, the better chances you have at finding something that fits your unique needs like Cinderella’s glass slipper.

Account Management and Cancellation Policies

A good vendor will provide dedicated account management support – someone who knows your name (and how to pronounce it), understands your goals and helps optimize strategies.

This, my friends, can make all the difference between feeling lost at sea or cruising smoothly towards success island.

The Core Growth Program: Your Dedicated Account Manager

- A dedicated account manager should be part of any core growth program provided by an insurance lead company.

- This person would work closely with you to understand specific needs & challenges related to generating quality insurance leads.

- They’ll also guide on best practices around managing these resources effectively.

If cancellation policies are hidden behind jargon-filled walls taller than Game of Thrones’ Wall…run. It’s essential that the conditions of what transpires if things don’t go as planned are made clear.

Note: As an agent looking for aggressive growth opportunities, inquire about accelerated growth programs and availability of agency business consultants while comparing vendors.

Remember folks; evaluating potential growth isn’t just about numbers but also understanding how well a vendor aligns with your long-term vision & provides value beyond mere transactions.

So put on those detective glasses and start asking these questions today.

How Do We Pick The Best Lead Companies?

We choose the best lead vendors online by creating a 3 step process.

1: Online Reviews: We first take a look at hundreds of online reviews from sites like Google, Reddit, thought leaders and 3rd party review sites.

2: Active Agent Polls: Then, we tap into our vast database of over 4000 active insurance agents that are buying online leads on a daily basis.

3: Testing Internally: After we have narrowed down the best of the best into 8-10 lead companies, we purchase some leads for ourselves. 2 of our Co-Founders here at Badass Insurance Leads are actively practicing sales agents for a large IMO here in Florida. We layered in the results of this test with steps one and two above and came up with our top 5.

Conclusion

Looking for the best insurance lead companies can be tough, but asking the right questions and evaluating growth opportunities can help you make an informed decision.

After researching various options, we’ve identified the top five insurance lead companies: SmartFinancial, Datalot, QuoteWizard, Hometown Quotes, and EverQuote.

Each of these providers offers unique features and benefits that cater to different business needs, so you can find the perfect fit for your agency.

Don’t just take our word for it, though. Check out these credible sources to see what others are saying about the best insurance lead companies:

- Nerdwallet’s Article on the Top Insurance Companies in 2023

- Insurance Lead Reviews

- TrustRadius’ Top Insurance Lead Generation Software

With the right partner, you can take your business to the next level and achieve your goals.