Final Expense Insurance Scripts for Sales Success

DOWNLOAD THE FINAL EXPENSE SALES SCRIPT HERE

Final expense insurance scripts are essential tools for agents and brokers looking to effectively sell one of the simplest life insurance products on the market (either on the phone or in-person!)

The Importance of Final Expense Insurance Sales Scripts

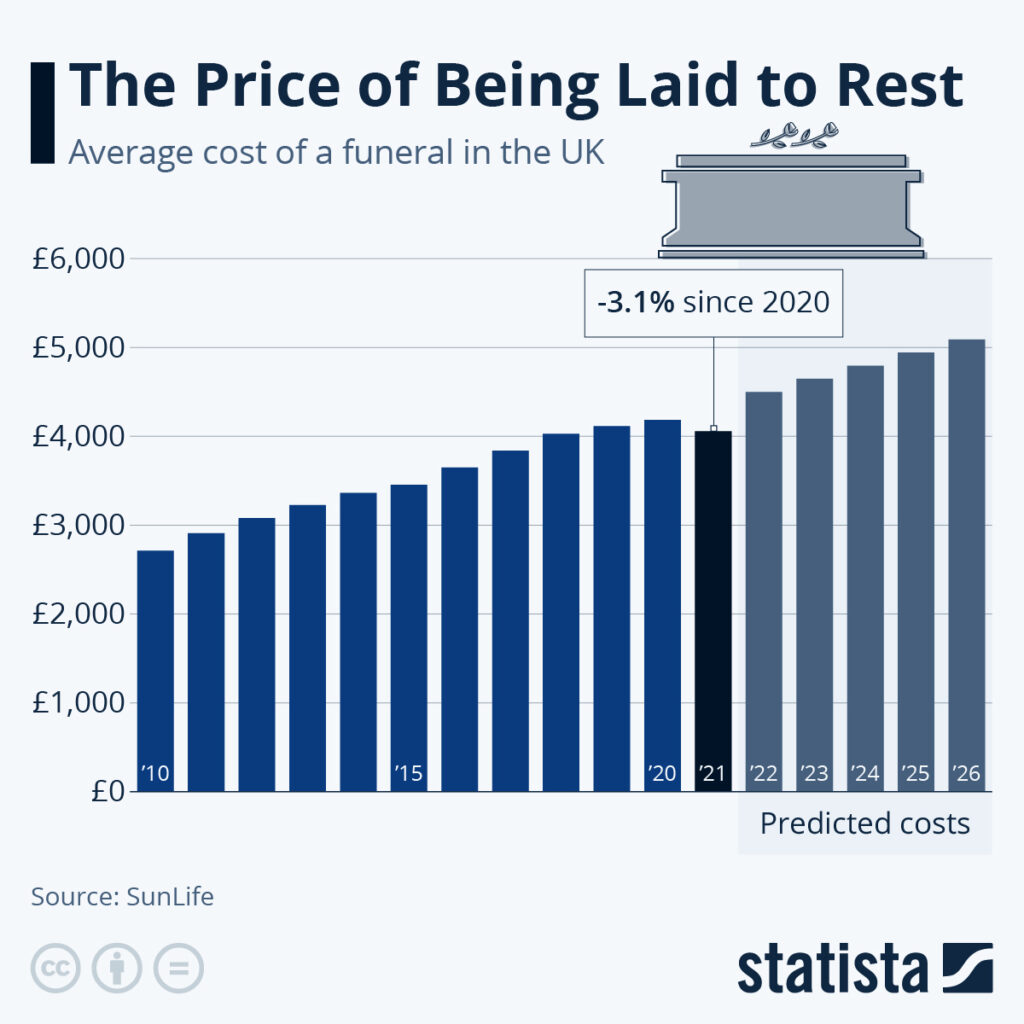

As the cost of funerals and final expenses continues to rise, outbound dialing offers agents an efficient way to reach more leads. A well-crafted sales script can make all the difference in securing appointments and closing deals over the phone. In this section, we’ll discuss why it’s crucial for insurance agents to have a strong final expense insurance sales script.

Rising funeral costs driving demand for final expense coverage

According to National Funeral Directors Association (NFDA), the median cost of a funeral with burial has increased by 29% since 2004. This rapid increase in prices has led many individuals and families to seek out financial protection through final expense insurance policies. As an agent, having a persuasive sales script tailored specifically for this market segment is essential in order to capitalize on this growing demand.

Benefits of outbound dialing in reaching potential clients

- Increased efficiency: Outbound dialing allows you to proactively reach out to potential clients instead of waiting for them to come across your marketing materials or contact you directly.

- Better targeting: By purchasing aged leads from companies like Badass Insurance Leads, you can ensure that your outreach efforts are focused on prospects who have already expressed interest in obtaining life insurance coverage.

- Faster results: With effective scripts and targeted lead lists, outbound calling campaigns can quickly generate new business opportunities compared with other marketing methods such as direct mail or online advertising.

In order for these benefits of outbound dialing campaigns be fully realized, it’s important that agents develop and utilize powerful final expense insurance sales scripts. These scripts should be designed to quickly establish rapport, identify the prospect’s needs, and present a compelling solution that addresses their concerns.

DOWNLOAD THE FINAL EXPENSE SALES SCRIPT HERE

Crafting Dynamic Closing Scripts

Creating effective final expense insurance sales scripts involves understanding your prospect’s needs, empathizing with their situation, and offering tailored solutions that fit their requirements. In this section, we will explore techniques on how to craft dynamic closing scripts that lead prospects closer to making a decision.

Understanding Your Prospect’s Pain Points

To create persuasive closing scripts, it is essential to understand the pain points of your potential clients. By identifying these concerns early in the conversation, you can better address them and demonstrate how your final expense insurance products can alleviate those worries. For example, consider discussing rising funeral costs or the financial burden left on family members after a loved one passes away.

Demonstrating Empathy During Conversations

In order to establish a strong connection with potential clients, exhibiting empathy during conversations is essential. When discussing sensitive topics like end-of-life expenses and funeral arrangements, expressing genuine concern for their well-being helps establish trust and makes prospects more receptive to your recommendations. Remember to listen actively during conversations – acknowledging their feelings while providing reassurance that you have solutions designed specifically for their needs.

Offering Tailored Solutions Based on Individual Needs

- Personalized Coverage: Customize policies based on factors such as age, health status, desired coverage amount, and budget constraints by presenting various options from multiple carriers if possible.

- Educate Prospects: Help them understand different types of final expense insurance plans available (e.g., whole life vs term) so they can make informed decisions about which product best suits their unique circumstances.

- Showcase Value-Added Benefits: Highlight additional benefits like policy riders, accelerated death benefit options, or funeral planning assistance to differentiate your offerings from competitors.

Incorporating these techniques into your final expense insurance sales scripts can help you create compelling closing arguments that resonate with prospects and guide them toward making a decision. By understanding their pain points, demonstrating empathy, and offering tailored solutions based on individual needs, you increase the likelihood of securing appointments and ultimately closing deals over the phone.

Our Tips for Winning Life Insurance Sales Scripts

Incorporating BAIL’s valuable tips on creating winning life insurance sales scripts can help you close deals effectively. By applying these strategies to your approach, you can increase the likelihood of successfully guiding prospects through each stage of the buying process – from initial interest to commitment.

Establishing Trust Early in Conversation

Building trust with potential clients is essential for successful final expense insurance sales. To establish trust early in conversation, be transparent about your intentions and demonstrate that you genuinely care about their needs. For example, introduce yourself as an expert in final expense coverage and assure them that your goal is to provide a solution tailored specifically for their situation.

Asking Open-Ended Questions

To gain a deeper understanding of your prospect’s needs and pain points, ask open-ended questions that encourage detailed responses rather than simple yes or no answers. This will not only help you gather valuable information but also engage the prospect actively in conversation. Some examples include:

- “Can you tell me more about any concerns regarding funeral expenses?”

- “What are some important factors when considering final expense coverage?”

- “How would having adequate coverage impact your family’s financial condition?”

Addressing Objections Proactively

Avoid waiting until objections arise during calls; instead, address common concerns proactively by incorporating them into your script. Demonstrating empathy while addressing objections can go a long way toward easing doubts and moving prospects closer to making a decision.

Incorporating these tips into your final expense insurance sales scripts can significantly improve your success rate when reaching out to potential clients. Remember, the key is to build trust, engage prospects actively through open-ended questions, and address objections proactively with empathy and understanding. Final expense insurance is one of the simplest life insurance products that can help cover funeral expenses and provide a death benefit to the beneficiaries. It is important to understand the prospect’s financial condition and offer them the best final expense policies that suit their needs.

DOWNLOAD THE FINAL EXPENSE SALES SCRIPT HERE

Utilizing Convoso’s Best Practices for Phone Sales Success

As an insurance agent, it’s essential to stay updated on the latest strategies and techniques designed specifically for selling final expense insurance over the phone. Convoso (top rated phone dialer system) has compiled a list of best practices that are proven effective at increasing conversion rates while maintaining rapport with potential clients throughout every call interaction. In this part, we will examine some of the key tactics that could help you close more sales.

Focusing on Benefits Rather Than Features

When discussing final expense insurance policies with your prospects, focus on the benefits they will receive rather than just listing features. This approach helps them visualize how their lives would improve by having such coverage in place. For example, instead of mentioning specific dollar amounts or policy terms, emphasize how a policy could provide peace of mind knowing their loved ones won’t be burdened financially during an already difficult time.

Creating Urgency Without Pressuring Customers

To motivate prospects to take action sooner rather than later, create a sense of urgency without making them feel pressured or rushed into making a decision. You can achieve this by highlighting statistics about rising funeral costs and sharing real-life stories from people who have benefited from having final expense coverage in place when they needed it most.

Using Storytelling as a Persuasive Tool

- Tell relatable stories: Share anecdotes about individuals who faced similar situations as your prospect and explain how final expense insurance helped ease their financial burdens.

- Show empathy: Make sure your storytelling demonstrates understanding and compassion towards the challenges faced by those dealing with end-of-life expenses.

- Highlight the positive impact: Focus on how having final expense insurance in place can bring peace of mind and financial security to both policyholders and their families.

Emphasizing the advantages, creating a sense of urgency without forcing it, and utilizing storytelling as an effective technique will all help you in your journey to convincing customers and guiding them through each step from initial interest to making the purchase. By focusing on benefits, creating urgency without pressure, and using storytelling as a persuasive tool, you’ll be well-equipped to guide prospects through each stage of the buying process – from initial interest to commitment.

Measuring Script Effectiveness & Continuous Improvement

To ensure the success of your final expense insurance sales scripts, it’s crucial to measure their effectiveness and make improvements based on data-driven insights. By tracking key performance indicators (KPIs) and analyzing call recordings, you can identify areas for improvement and optimize your approach.

Identifying Relevant KPIs for Script Evaluation

The first step in measuring the effectiveness of your sales scripts is identifying which KPIs are most relevant to your goals. Some common KPIs used by insurance agents include:

- Conversion rate: The percentage of leads that turn into customers after interacting with your script.

- Average handle time: The average amount of time spent on each call, including talk time and hold time.

- Contact rate: The percentage of calls where an agent successfully reaches a lead.

- Appointment setting rate: The percentage of successful appointments set during phone interactions.

Analyzing Call Recordings to Uncover Trends

Call recording analysis is an invaluable tool for understanding how well your final expense insurance sales scripts are performing. By listening to recorded calls, you can pinpoint specific areas where agents may be struggling or excelling. This information will help guide adjustments to improve overall results. Consider using speech analytics software like CallMiner Eureka, which automatically transcribes conversations and identifies patterns across large volumes of calls. (We recently noticed that CallRail does the same thing using AI!)

Implementing Changes Based on Data-Driven Insights

Informed by your KPIs and call recording analysis, you can now make data-driven adjustments to your sales scripts. Some potential changes may include:

- Revising the script’s structure or wording to better address common objections.

- Adjusting the pacing of the conversation to keep prospects engaged.

- Incorporating new techniques, such as storytelling or open-ended questions, that have proven effective in other areas of your business.

Remember that continuous improvement is an ongoing process. Regularly monitor performance metrics and analyze calls to ensure that your final expense insurance sales scripts remain effective over time. By staying committed to this iterative approach, you’ll be well-positioned for long-term success in selling final expense insurance policies.

FAQs in Relation to Final Expense Insurance Scripts

What is the average face amount of final expense policies?

The average face amount for final expense policies typically ranges between $5,000 and $25,000. However, this can vary depending on factors such as age, health status, and individual needs. It’s essential to assess each client’s situation to determine the appropriate coverage level.

How do you explain final expense insurance?

Final expense insurance is a type of life insurance designed to cover end-of-life expenses like funeral costs and outstanding debts. Unlike traditional life insurance policies that provide income replacement or wealth transfer benefits, its primary purpose is easing financial burdens for loved ones during a difficult time.

How much can you make selling final expense insurance?

Earnings from selling final expense insurance depend on factors like commission rates, policy premiums, sales volume, and personal effort. On average, insurance agents earn 50-110% of first-year premiums with renewal commissions ranging from 2-12%. Successful agents can potentially earn six-figure incomes annually.

DOWNLOAD THE FINAL EXPENSE SALES SCRIPT HERE

Conclusion

In conclusion, crafting effective final expense insurance sales scripts is crucial for insurance agents and brokers to successfully reach potential clients and offer tailored solutions based on individual needs. By understanding the rising demand for final expense coverage due to increasing funeral costs, establishing trust early in conversations, focusing on benefits rather than features, and continuously measuring script effectiveness through KPIs and call recordings analysis, agents can improve their phone sales success rates.

If you’re an insurance agent or broker looking to generate more leads for your final expense insurance business, check out Badass Insurance Leads. Our high-quality leads are pre-screened so you can focus on selling instead of prospecting.