Best Power Dialers for Insurance Agents: Ultimate Guide

TLDR: Our #1 pick for insurance agents & brokers is PhoneBurner.

Discovering the best power dialers for insurance agents is crucial to optimizing productivity and maintaining compliance in today’s competitive market. This guide will provide an in-depth exploration of auto-dialers and their advantages, as well as review some of the best solutions tailored for insurance agents to help them maximize productivity while adhering to regulations.

What is an Auto Dialer?

An auto dialer, officially known as an Automatic Telephone Dialing System (ATDS), is a device designed to store or generate phone numbers, randomly or sequentially, and then dial them automatically. For insurance agencies and independent agents, an auto dialer streamlines the process of reaching out to leads. This technology significantly outpaces the efficiency of manual dialing, ensuring timely and consistent follow-up with prospects. Especially when an initial call doesn’t result in a sale, an auto dialer becomes an indispensable tool for agents, aiding them in maintaining thorough communication without missing a beat.

The Importance of Power Dialers for Insurance Agents

For insurance agents dealing with aged leads, power dialer systems are essential tools that help scale their calls and improve productivity. These software solutions simplify the process of making outbound calls while offering a range of features such as DNC registry compliance, pop-up recording, three-way conferencing, dynamic call monitoring, CRM integration tools, custom dispositions and support for texting and emailing.

Boosting Productivity Through Efficient Calling Methods

A power dialer enables insurance agents to make more phone calls in less time by automating repetitive tasks like dialing numbers and leaving voicemails. This increased efficiency allows them to focus on providing excellent customer service during live conversations. Some popular power dialers even offer voice broadcasting capabilities which allow agents to send pre-recorded messages to multiple contacts at once.

Are Auto Dialers Illegal?

Auto dialers themselves are not inherently illegal. Their legality depends on how they are used. Their use is legitimate in compliance with regulations such as the TCPA and federal robocalling laws. However, using them for unsolicited telemarketing calls, sending unauthorized pre-recorded messages, or not following other specific guidelines can make their use illegal. Always ensure that an auto dialer adheres to current regulations and best practices.

Understanding the Telephone Consumer Protection Act (TCPA)

Introduced in 1991, the TCPA restricts certain uses of auto-dialers for telemarketing, automatic dialing systems, and transmitting artificial or pre-recorded messages. Under this act, unauthorized telemarketing calls, faxes, and automated text messages to cell phones can lead to severe penalties. However, not all auto-dialing is prohibited; compliance with TCPA guidelines makes it lawful.

Auto Dialers & RoboCall Rules

Robocalling, which involves using pre-recorded messages, has specific regulations under federal law. Using auto-dialers for robocalls without prior written consent is illegal, whether the call is directed to a landline or cellphone. There are exemptions, like emergency announcements or informational messages, but promotional or telemarketing robocalls require clear consent.

Finding Updated Information on TCPA and Robocall Regulations

For the most relevant and up-to-date information on the TCPA and robocall laws, one should consult:

- Federal Communications Commission (FCC) Website: The FCC directly oversees and enforces the TCPA and robocall regulations. Their website provides detailed information, updates, and resources regarding these rules. Visit: www.fcc.gov

- Federal Trade Commission (FTC) Website: The FTC deals with consumer protection and provides valuable resources on unwanted telemarketing calls, including robocalls. Visit: www.ftc.gov

It’s always a good practice to regularly check these official websites or consult a legal expert specializing in telecommunications law to ensure compliance with the latest regulations.

Types of Auto-Dialers in the Market

Different types of auto-dialers are available in the market to meet various needs and preferences, making it important for insurance agents to select the right one. Each type has its unique features and benefits, making it essential for insurance agents to choose the right one that suits their requirements. Let’s explore some popular auto-dialer categories:

Predictive Dialers

Predictive dialers use algorithms to determine when an agent will be free and automatically initiate calls based on this prediction. This approach helps minimize idle time between calls, ensuring that agents spend more time speaking with potential clients rather than waiting for connections.

Progressive Dialers

In contrast, progressive dialers automatically move through a call list without waiting for input from the agent. As soon as an agent finishes a call, the system dials the next number on the list immediately. This method ensures consistent productivity by keeping agents engaged in continuous phone conversations.

Preview Dialers

Preview dialers, on the other hand, allow users to view information about each contact before initiating a call. Agents can review details such as previous interactions or specific notes about a lead before deciding whether or not they want to proceed with calling them.

A good preview dialer combines all three calling methods while enabling tracking warm customers for follow-up calls – ultimately helping insurance agents improve their sales performance and customer service.

When selecting an auto-dialer, it is crucial to consider factors such as compliance with the Telephone Consumer Protection Act (TCPA), integration capabilities with CRM systems, call monitoring features, and support for voice broadcasting. These aspects will ensure that your chosen dialer not only boosts productivity but also adheres to industry regulations.

Auto-dialers can be a useful asset for insurance agents, but it is essential to comprehend the variations between each variety prior to committing. This article will provide an overview of some of the most popular auto dialing solutions available.

Voice Broadcasting Dialers

Voice Broadcasting Auto Dialers are systems that automatically send pre-recorded voice messages to a list of contacts. They’re often used for notifications, reminders, alerts, promotions, or political campaigns. Instead of manually dialing each number to convey a message, these dialers broadcast the message to multiple recipients simultaneously.

As for legality, while voice broadcasting can be a potent tool, it’s essential to remain compliant with regulations like the TCPA in the U.S. Sending unsolicited voice broadcasts, especially for telemarketing purposes, can be deemed illegal without proper prior consent. Moreover, certain exemptions apply, such as emergency notifications. Always ensure voice broadcasting is aligned with the latest regulations to avoid potential legal consequences.

Auto Dialer Features: Streamlining Insurance Operations

Auto dialers have various features to enhance efficiency and improve the calling experience. When choosing an auto dialer for your insurance business, consider the following functionalities:

- Lead Qualification Tools: Post-call, some dialers offer tools to rank prospects on a scale, like “cold” to “warm,” aiding lead prioritization.

- Answering Machine and Email Integration: Advanced dialers can detect answering machines, allowing agents to decide the next steps. The integrated email function can be handy for sending quotes or additional information to prospects.

- Calendar and Task Integration: Helps agents stay on top of their schedules. The auto dialer can auto-populate the calendar based on call activities and set reminders.

- CRM Integration: An integrated CRM streamlines the calling process. Look for intuitive CRMs that automate data entry, offer one-click outbound calling, and efficiently manage inbound calls.

- DNC Scrubbing: A must-have feature that helps agents avoid calling numbers on the Do Not Call (DNC) list. Ensure your dialer has an updated and compliant DNC scrubbing mechanism.

- Dialing Options: Choose between single-line or multi-line dialers based on your business needs. Single-line dialers are known for immediate connections without noticeable delays.

- Script Assistance: Some CRMs can display suggested talking points or scripts during calls for agents needing a prompt.

- Three-Way Conferencing: A valuable tool for an agent to bring a senior colleague into a call, especially for complex queries or closing deals.

- Call Recording and Monitoring: Essential for quality assurance and training, allowing managers to review calls and provide feedback.

- Dynamic Caller ID: Studies suggest local numbers boost answer rates. Dynamic caller IDs can display a number matching the prospect’s area code, increasing their chance of answering.

Our Top Picks: Auto-Dialing Solutions for Insurance Agents

Insurance agents have a variety of auto-dialing solutions to choose from, each offering unique features and benefits. Some popular options recommended by industry professionals include:

PhoneBurner

PhoneBurner is a state-of-the-art Power Dialer and Customer Acquisition platform that energizes millions of conversations monthly. Now updated for Apple’s Live Voicemail, it revolutionizes 1-to-1 communications, enhancing live engagements fourfold. Seamlessly blend calls, emails, and SMS. Access features like automated call logging, Branded Caller ID, call coaching, and detailed analytics. With 100+ integrations, including Salesforce and Hubspot, it’s the linchpin in converting leads to revenue swiftly.

Key Features:

- Cloud-based power dialer with no software to install.

- Seamless CRM integration for efficient lead management.

- Real-time analytics and reporting tools.

Competitive Advantages:

No Software Installation: Being entirely cloud-based without needing software installation, PhoneBurner offers flexibility and ease of use, especially for businesses that want to avoid complex setups.

DialedIn by ChaseData

DialedIn by ChaseData offers a comprehensive cloud-based call center solution tailored for both inbound and outbound operations. With an emphasis on the insurance industry, it ensures TCPA compliance and provides robust security through PCI DSS, HIPAA HITECH, and SOC2 standards. The platform boasts API integrations, data management, and dashboards. It also supports a range of communication modes, including voice, email, SMS, and web chat. With its diverse features, ChaseData offers both a free trial and competitive pricing.

Key Features:

- Robust auto dialing solutions tailored for call centers.

- Multi-level IVR for efficient call routing.

- Comprehensive reporting and analytics for performance tracking.

Competitive Advantages:

Tailored for Call Centers: Their robust auto dialing solutions are specifically designed to cater to the needs of call centers. This specialization may provide optimizations not found in more general solutions.

Nextiva Cloud-Based Software Suite

Nextiva’s integration with prominent CRMs, including HubSpot, Salesforce, and Zendesk, offers seamless one-click calling, enhancing outbound efficiency. While not a traditional auto dialer, Nextiva’s VoIP platform ensures smooth telephony syncing via Go Integrator, enriching reps’ call and contact view. Nextiva boasts voice and video calling, texting, team messaging, and faxing as a comprehensive communications solution. Celebrated for its affordability, it streamlines sales and customer experience with robust features and exemplary support.

Key Features:

- Advanced auto dialer with quick setup.

- Comprehensive analytics and reporting tools.

- Seamless integration with leading CRMs.

Competitive Advantages:

Quick Setup: For businesses looking for a quick rollout, Nextiva’s emphasis on fast setup can be an attractive proposition.

Five9 Solution

Five9 is a premier CCaaS platform offering a versatile suite for contact centers. Its cloud software is equipped with advanced AI capabilities, allowing seamless management of customer interactions across voice, chat, email, and more. Beyond just software, Five9 champions an exceptional customer experience, empowering agents to engage on various channels while providing managers with critical performance insights. Though not the most budget-friendly, its robust features and commitment to CX excellence stand out.

Key Features:

- Cloud-based predictive dialer with intelligent algorithms.

- Omnichannel routing to reach customers through their preferred channel.

- Real-time and historical reporting for improved decision-making.

Competitive Advantages:

Intelligent Predictive Dialing: Their cloud-based predictive dialer uses advanced algorithms to increase connect rates, thus potentially enhancing agent productivity.

VanillaSoft

VanillaSoft excels as an auto dialer tailored for navigating intricate customer journeys. Through its innovative Intellective Routing, leads are systematically prioritized, ensuring reps dial the right prospect at the right time. Seamlessly integrating with major CRMs like Salesforce, it captures critical lead data during calls, enhancing follow-ups and enriching the sales process. This platform beautifully melds dialing precision with comprehensive lead management.

Key Features:

- Intellective Routing for tailored lead management.

- Comprehensive lead tracking with custom fields.

- Corporate View for managing multiple contacts from a single organization.

Competitive Advantages:

- Intellective Routing: This feature allows businesses to be very specific in managing leads, ensuring the right agent handles the right lead.

- Corporate View: This feature provides a holistic view for businesses that deal with multiple contacts within a single company, enhancing relationship management.

RingCentral

RingCentral Engage Voice safeguards against regulatory breaches, ensuring legal, large-scale outreach. This auto dialer has tools for scrubbing Do Not Call lists and ensuring timely calls. Key features like the TCPA Dialer maintain compliance without compromising productivity. Its powerful scripting capabilities, streamlined workflows, and robust reporting empower teams. With expansive CRM integrations, RingCentral, a top-rated UCaaS & CCaaS solution, centralizes business communications.

Key Features:

- Comprehensive compliance tools for safe outreach.

- Advanced scripting features for effective communication.

- Seamless CRM and software integrations.

Competitive Advantages:

Advanced Scripting: Effective communication is key, and their advanced scripting features ensure that agents are always on message, potentially enhancing customer interactions.

Kixie

Kixie is a premier sales engagement platform integrated with leading CRMs like HubSpot, Salesforce, and Pipedrive. It transforms website leads into real-time conversations, prioritizing inbound leads with its auto dialer. The platform boasts automated calling and texting, one-click integrations, and PowerCall capabilities via a Chrome extension for streamlined dialing. Alongside efficient logging, its features include AI-enhanced local presence and live call coaching, offering a holistic sales solution.

Key Features:

- Power dialer for efficient outbound calls.

- Integration with leading CRMs for data synchronization.

- Real-time call coaching features.

Competitive Advantages:

Real-time Call Coaching: Kixie offers features that allow for real-time call coaching. This could be immensely beneficial for training purposes and ensuring call quality.

NICE CXone

NICE CXone stands at the forefront of cloud call center solutions, concentrating on fostering unparalleled experiences between businesses and their consumers. Pioneering in delivering digital-first, personalized experiences, CXone integrates Omnichannel Routing, Analytics, AI, and Workforce Optimization on an Open Cloud Foundation. This platform champions superior customer encounters, buoyed by a robust DEVone ecosystem and 24/7 global support.

Key Features:

- Predictive dialing with advanced algorithms for optimal connect rates.

- Comprehensive compliance management.

- Real-time analytics for improved strategies.

Competitive Advantages:

Advanced Compliance Management: Ensuring calls comply with regulations is crucial. Nice CXone emphasizes this, which can be invaluable for businesses wary of legal complications.

Talkdesk

Talkdesk® stands out as a global leader in cloud contact center solutions. Championing AI-driven customer experiences, their automation-first approach streamlines customer service processes across various industries. With partnerships from giants like IBM and Trivago, they serve over 1,800 innovative companies globally. Talkdesk offers the unified Talkdesk CX Cloud™, Industry Experience Clouds™, and Talkdesk Phone. These platforms, designed for speed, agility, and reliability, ensure a seamless customer journey while catering to industry-specific needs.

Key Features:

- AI-driven automation-first customer experience.

- Talkdesk CX Cloud™ for an integrated, seamless experience.

- Industry-specific solutions with Talkdesk Industry Experience Clouds™.

Competitive Advantages:

- AI-driven Automation: In an age where AI transforms industries, TalkDesk’s AI-driven customer experience solutions offer potentially groundbreaking optimizations.

Industry-Specific Solutions: TalkDesk offers solutions tailor-made for specific industries, which can be invaluable for businesses in niche sectors.

Voicent Cloud

Voicent Cloud offers a tailored auto dialer solution for occasional massive outreach without the hefty cost. Beyond the typical auto dialer, it integrates progressive and preview dialers, ensuring versatile engagement. Notably cost-effective, Voicent empowers companies to increase their outreach efficiency, making numerous connections per hour. The platform balances affordability with robust support, including a dedicated account representative.

Key Features:

- Multiple auto dialing modes, including progressive and preview dialers.

- Built-in CRM for comprehensive lead tracking.

- Pay-as-you-go plans for tailored needs.

Competitive Advantages:

- Flexible Pricing: Their pay-as-you-go plans are perfect for businesses that don’t require continuous auto dialing, potentially offering cost savings.

Multiple Dialing Modes: From progressive to preview dialers, Voicent Cloud offers various dialing modes, providing flexibility in outreach strategies.

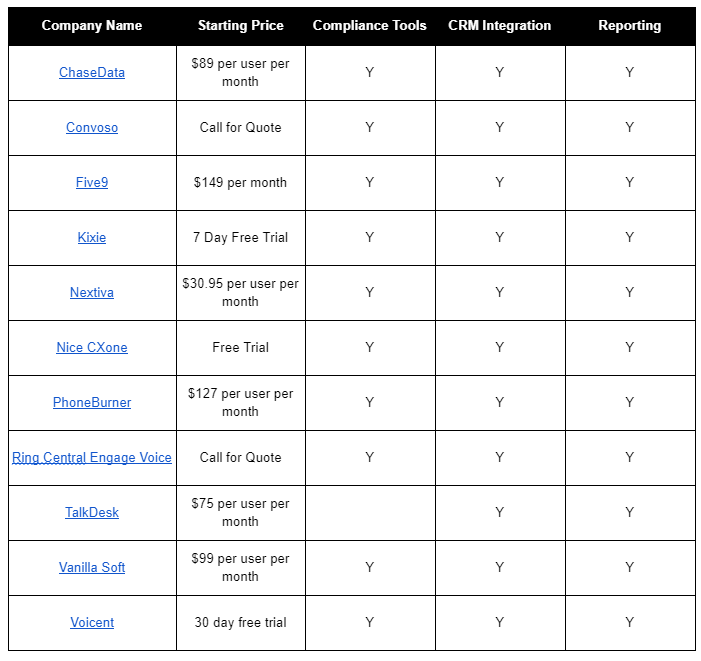

Phone Dialer System Comparison Table

——-

Why is PhoneBurner Our #1 Pick?

Among the various auto-dialing solutions available, PhoneBurner stands out as a powerful option favored by many insurance professionals. Users claim that it has been instrumental in increasing live conversations up to 4x more than traditional methods. This impressive boost in productivity is achieved through PhoneBurner’s streamlined approach to handling repetitive tasks and its user-friendly interface.

Increased Live Conversations

The primary goal of using an auto-dialing software for insurance agents is to maximize the number of live conversations with potential clients. PhoneBurner achieves this by offering features such as smart lead distribution, local presence dialing, and real-time call monitoring. These capabilities ensure that agents can connect with more leads quickly and efficiently while maintaining high-quality customer service.

Streamlining Repetitive Tasks

- Contact Management: PhoneBurner simplifies contact management by allowing users to import contacts from various sources like CRMs or spreadsheets easily.

- Emails & Voicemails: With one-click actions, agents can send personalized emails or leave pre-recorded voicemails when calls go unanswered – saving valuable time during outreach campaigns.

- Detailed Call Logging: The platform automatically logs all call details (including dispositions) into your CRM system without any manual input required from the agent.

- Campaign Customization: Insurance agents can create custom campaigns tailored specifically for their target audience – ensuring better engagement rates and higher conversions on each call made through PhoneBurner’s platform.

In addition to these features, PhoneBurner also offers seamless CRM integrations with popular platforms like Salesforce, HubSpot, and Zoho. This means that agents can access all the necessary information about their leads without leaving the dialing platform – further enhancing productivity and efficiency during call campaigns.

PhoneBurner is a powerful option favored by many professionals due to its ability to increase live conversations and streamline repetitive tasks. With this in mind, Forbes Advisor has conducted research on auto dialer providers which will be discussed next.

When Should Insurance Agents Invest in Auto Dialer Software?

For insurance agents and agencies, timing is everything. Consider investing in auto dialer software if:

- Volume Overwhelms: Manually dialing is slowing you down, and there’s a noticeable backlog of leads.

- Lead Conversion Slips: If you notice leads going cold due to delays in follow-ups or lack of consistent touchpoints, automation can help.

- Team Expansion: As your team grows, centralized software ensures consistency and efficiency in outreach.

- Quality Assurance: Need insights into agent performance? Auto dialers with call recording provide valuable feedback.

- Operational Efficiency: If administrative tasks overshadow core sales activities, it’s time to automate and streamline.

By pinpointing needs and assessing growth, agents can make a timely and informed decision on auto dialer investments.

Criteria for Ranking Auto-Dialers

The comprehensive evaluation process used by Forbes Advisor ensures that only the top-performing auto-dialers make their list. By considering a wide range of factors such as software features like predictive dialing, sophisticated CRM integration tools, and efficient call monitoring systems along with user satisfaction ratings from actual customers who have tested the products themselves – they provide valuable insights into which solutions are worth investing in.

The Future of Auto Dialing: AI at the Helm

As the technological landscape rapidly evolves, auto dialing is poised to undergo significant transformations fueled by Artificial Intelligence’s (AI) capabilities. The following list includes current capabilities being embraced by forward-thinking companies and potential applications that AI could bring to the auto dialing domain in the near future. By harnessing the power and intelligence of AI, these features aim to enhance the efficiency, personalization, and responsiveness of auto dialing systems:

- Smart Predictive Dialing: AI can analyze data to predict the best times to call leads, increasing the likelihood of successful connections.

- Sentiment Analysis: AI can gauge a prospect’s interest level by assessing the tone and words used during a call, helping agents tailor their pitch in real time.

- Voice Assistants & Chatbots: For basic inquiries, AI-powered voice assistants can handle initial calls, directing more complex queries to human agents.

- Enhanced Personalization: Using AI to analyze past interactions and data, the software can suggest more personalized pitches or talking points for agents.

- Call Analytics: Post-call analysis can provide insights into call performance, identifying areas for training or script refinement.

- Improved CRM Integration: AI can automatically update CRM systems based on call outcomes, ensuring data accuracy and saving time.

- Fraud Detection: AI can identify suspicious call patterns, protecting businesses from potential scams or fraudulent activities.

As AI continues to evolve, its synergy with auto dialers promises

FAQs in Relation to Best Power Dialers for Insurance Agents

Are Power Dialers Illegal?

Power dialers are not illegal, but their usage must comply with regulations such as the Telemarketing Sales Rule (TSR) and the Telephone Consumer Protection Act (TCPA). These laws protect consumers from unwanted calls and require businesses to maintain a Do Not Call list.

What Is the Difference Between a Power Dialer and a Progressive Dialer?

A power dialer dials one number at a time, waiting for an agent to be available before initiating the call. A progressive dialer automatically dials numbers in sequence when agents become available, reducing idle time. Power dialers provide more control over calls while progressive ones maximize efficiency.

What Is the Difference Between Predictive and Progressive Dialers?

Predictive dialers use algorithms to predict agent availability and initiate multiple simultaneous calls, connecting only answered calls to available agents. Progressive dialers wait for an agent’s availability before starting each call sequentially. Predictive systems optimize productivity but may lead to higher dropped-call rates compared to progressive ones.

Why Use a Power Dialer?

- Increase calling efficiency

- Achieve better contact rates

- Easily manage leads

- Maintain regulatory compliance

- Automate repetitive tasks like voicemail drops or email follow-ups

Conclusion

Overall, power dialers are essential for insurance agents to boost productivity and ensure regulatory compliance. There are various types of auto-dialers in the market, including predictive, progressive, and preview dialers. Top-rated options include Nextiva Cloud-Based Software Suite, Five9 Solution, RingCentral, Nice inContact and ChaseData.

PhoneBurner is a powerful option favored by many professionals due to its ability to increase live conversations and streamline repetitive tasks. Forbes Advisor’s research on auto-dialer providers highlights the criteria for ranking these solutions as well as the top performers according to their research. SmartCalls is revolutionizing insurance prospecting with up-to 400 appointments per month while reducing non-revenue generating activities.

If you’re an insurance agent looking for the best power dialers available on the market today that can help you save time and close more deals faster than ever before, then check out Badass Insurance Leads! With our state-of-the-art technology, we provide high-quality leads that will help you grow your business quickly, so don’t wait any longer – visit us now!