Calculating Your Needs: How Much Life Insurance Do I Need?

Life insurance may not be a fun topic, but it’s essential for anyone with people who rely on them.

That’s anybody with dependents like kids or a stay-at-home spouse or even small business owners with partners.

In this article, we’ll dive into calculating your life insurance needs. We’ll talk life insurance calculators, manually costing out coverage, and a couple of alternative ways of looking at life insurance.

But first, what is life insurance anyway?

What Is Life Insurance?

Life insurance is a contract with an insurer.

You pay monthly or annual premiums, and when you die, the insurance company pays out to your loved ones.

Think of it this way: Your family relies on your income to meet their daily living expenses.

Suddenly, you’re gone. And so is your salary.

That’s where life insurance comes in.

The payout can cover funeral costs and allow your family to continue their current lifestyle without stressing over finances.

But how much coverage do you need?

Cue the life insurance calculator above:-)

Using a Life Insurance Calculator

A life insurance calculator is a valuable tool that helps you determine the appropriate amount of coverage for your needs. It simplifies the life insurance calculation process, making it easier for agents and brokers to provide accurate recommendations to their clients.

Free Life Insurance Calculator

How Does a Life Insurance Calculator Work?

A life insurance calculator works by taking your data and providing an estimate for the appropriate amount of coverage.

Here are some key factors that a life insurance calculator takes into account:

- Your annual income: The general rule of thumb is to target coverage that is 10 times your annual income. This will allow your family to maintain their lifestyle if you’re no longer around.

- Funeral costs and final expenses: Believe it or not, the average funeral service can cost up to $8,000! By factoring in funeral costs and other end-of-life expenses, you can ensure that your policy provides enough coverage to account for these financial obligations.

- College expenses: If you have children, it’s important to include their future college expenses. By factoring in these costs, you can ensure that your life insurance policy provides enough coverage to help fund their education.

- Current debts: Don’t forget about your existing financial obligations. When determining how much coverage you need, consider your family’s credit card bills, car payments, mortgages, and student loans.

Once you input this information, the life insurance calculator will subtract the value of your existing assets and provide you with the right amount of coverage.

Just note that life insurance calculators have their limitations. For example, they may not consider the contributions of a stay-at-home parent. In such cases, manual calculations may be necessary to determine the appropriate coverage amount.

Key Takeaway:

Calculating the right life insurance coverage can be confusing. A life insurance calculator simplifies the process, considering factors like income and future expenses to provide accurate recommendations.

Term vs Whole Life Insurance

There are two major types of life insurance on the market today.

Term Life Insurance

Term life insurance provides coverage for a set period of time which generally coincides with your peak earning years. If you pass away during this term, your loved ones will receive a payout. If you outlive the term, they will not.

Some key points about term life insurance:

- Lower premiums compared to whole life insurance

- Simple structure

That said, there are some downsides to term life insurance:

- No lifetime protection

- No cash value accumulation

Whole Life Insurance

As the name suggests, whole life insurance provides coverage for your entire life. Some whole life insurance policies even have an investment component, allowing your policy to grow over time.

There are some definite advantages to whole life insurance:

- Coverage lasts until the end of your life

- Potential growth in cash value over time

However, there are some weaknesses to consider:

- Higher premiums, which can put a bigger strain on your wallet

- More complexity due to the investment aspects

Which option is the right choice for you?

It depends on factors such as your financial obligations and future plans.

Now let’s take a look at manually calculating your insurance coverage.

Manually Calculating Insurance Coverage

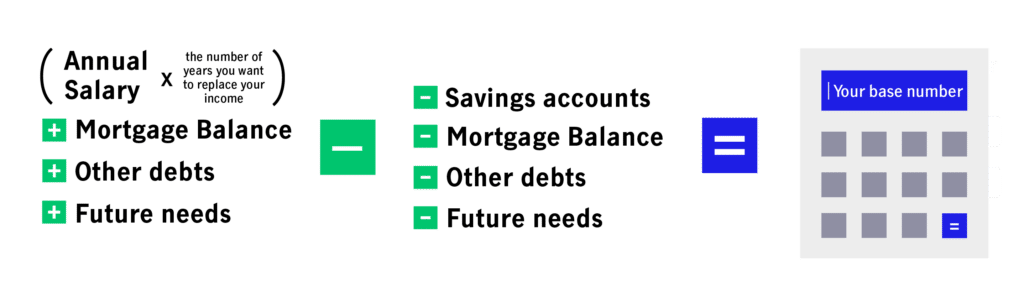

A life insurance calculator is a simple way to determine the amount of insurance coverage you need, but you can do the math by hand.

So, what parameters should you use?

Start with your annual income, multiply it by 10, then factor in the following:

- Your debts

- College expenses for your children

- Estimated funeral and burial costs

You should then include a buffer because, let’s face it, inflation is a fact of life. Add an extra 10% just to be safe.

That should give you your target coverage amount.

Considering College Expenses for Children

As we’ve said, it’s important to consider more than just your annual income.

Are your kids headed for higher education?

If so, it’s best to include those college costs in your life insurance calculation.

But How Much Coverage Do You Need?

- Take a look at current tuition rates.

- Multiply that by 4 to cover each year of undergraduate education.

- Factor in inflation.

Remember, an educated child is less likely to be financially dependent on you in adulthood.

Other Ways to Calculate Your Life Insurance Needs

So far, we’ve talked life insurance calculators and the process of manually costing out your coverage needs.

But there are other ways to look at life insurance.

Applying The DIME Formula

The DIME formula is a powerful method for determining your life insurance needs.

D is for Debt, I is for Income, M is for Mortgage, and E is for Education expenses

- Debt: Total up all of your debts, excluding your mortgage. Think credit card balances and car loans.

- Income: Take your annual income and multiply it by 10.

- Mortgage: Consider how much you owe or expect to owe in the future.

- Education expenses: If you have children, don’t forget to factor in future college costs. Estimate the tuition fees that you will need to cover.

Why does the DIME formula work so well? It takes into account your financial obligations and ensures that your loved ones are protected in the event of your passing.

Pro Tip: If you are a stay-at-home parent and don’t have an annual income, consider the financial value of your contribution to daily living expenses.

Replacing Income Plus Adding a Cushion

Another way to calculate your life insurance coverage needs is by multiplying your annual income by 10 and adding a 20% cushion to account for inflation and unforeseen expenses.

FAQs in Relation to How Much Life Insurance Do I Need

How much life insurance do you actually need?

The amount of life insurance you need varies based on personal circumstances. Typically, it’s recommended to have coverage that is 10-15 times your annual income.

Is $100,000 enough for life insurance?

$100,000 may be sufficient if you’re single with no dependents or debts. However, if you have a family and financial obligations, more coverage is probably necessary.

How much life insurance do my spouse and I need?

It’s generally advisable to get coverage equivalent to 10-15 times the annual income of the higher earner.

How much does a $5 million life insurance policy cost?

The cost of a $5 million life insurance policy varies based on age, health, and lifestyle. If you’re older, a smoker, or have a history of health problems, your premiums will be higher than it would be if you were a young person with a clean bill of health.

Conclusion

If people rely on you for their financial security, it’s essential that you have life insurance.

While most folks live past their peak earning years, accidents do happen. Plan for the worst, and you’ll ensure that your loved ones can maintain their current lifestyle long after you’re gone.

In this post we covered several ways to calculate your life insurance needs.

We discussed life insurance calculators, manually calculating coverage, and some alternative ways of looking at life insurance. We even covered the differences between term and whole life insurance.

At this point, you should know why life insurance is important and how to calculate the amount of coverage that’s right for you.

If you’re a life insurance agent looking to connect with aged leads who need help calculating their life insurance coverage needs, reach out to Badass Insurance Leads.

Quick Links: Life Insurance Leads, Health Insurance Leads, Medicare Insurance Leads