15 Online Tools for Life Insurance Agents (2023)

Understanding Insurance Agent Tools

Welcome to the digital era. You can definitley improve your insurance business by implementing any one of the digital tools that are out there right now.

They could be a game-changer for insurance agents and brokers. Why?

They streamline processes and boost efficiency.

And guess what? You can offer better service to your clients too.

TLDR: Here’s a quick list:

- Radiusbob

- AngencyBloc

- ScrapeIt

- DataMam

- Google Drive

- Dropbox

- Carbonite

- SharpenClicks

- TurboRater

- Epic Quotes

- QQ Catalyst

- AMS360

- Uptime RObot

- GT Metrix

- Constant Contact

Adapting to Changing Insurance Technology

How can digital tools compliment an insurance business with no digital tools?

- You can automate time-consuming tasks.

- No more paperwork nightmares.

- It helps you scale.

- It helps you manage your employees.

Software Types Used By Insurance Agents & Brokers

Let’s talk software.

The lifeblood of efficient management in insurance agencies.

CRMs? Check.

We like CRMs like Radiusbob and AgencyBloc. They both seem to be the higher rated ones amoung insurance agents and they come with a suite of tools that agents like / need. Oh yeah, the pricing isn’t going to break the bank either (They both double as AMS tools and we’ll mention them again below).

Data collection tools? Absolutely necessary. There are a ton our there but some of our favorite are ScrapeIt and DataMam. Both tools allow you to find data online, such as websites that contain valuable lead data, and turn that data into actionable sheets for you or your agents.

Cloud storage platforms such as Google Drive or Dropbox? Absolutely essential. You’ll need a place to store all of your valuable information from sales reports, to marketing materials. If youre looking for something that give syou a more secure ecosystem, take a look at Carbonite.

Need to generate leads? Use lead generation companies. We recommend doing a mix of fresh leads with aged leads. For aged life insurance leads, of course we recommend Badass Insurance Leads. For fresh leads, there are a TON of providers out there. After doing a ton of research and vetting, we’ve found that the team at Sharpen Clicks does the best. They use AI to generate up to 100 fresh, scheduled life insurance leads a month for you with no long term agreements.

And don’t forget about quoting and proposal engines – speed is key here. Our two favorite here are TurboRater and Epic Quotes.

Ever heard of Agency Management Systems (AMS)? It’s designed specifically to help insurance agencies organize their book of business and to more effecively run their operations. Some additional things an AMS helps with include but aren’t limited to…..

- Data management – check.

- Email marketing integration – got it covered.

- Campaign tracking – yes please.

Our top two picks here are some of the highest rated in customer reviews on G2. They are QQCatalyst and AMS360.

Website Monitoring as a Crucial Tool

Your website is your storefront.

It needs to be in top shape.

You wouldn’t ignore a broken window at your physical location, right?

Website monitoring tools can help.

The Importance of Regular Site Checks

Downtime equals lost business.

No one likes a 404 error page.

Check site uptime regularly.

Set up alerts for any downtime.

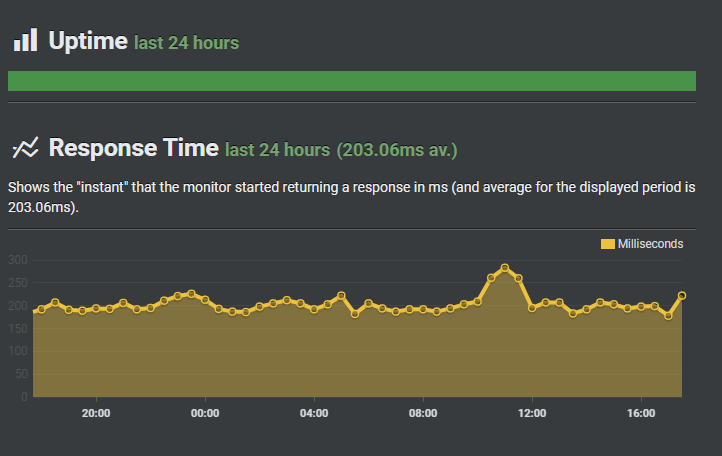

One of my favorite tools that gives me an alert when one of my wesbites goes down is UptimeRobot.com

It gives you a realtime alert when your website goes down due to server issues or can’t load for any reason. This way, you can fix it yourself or send immediately to your developer.

Potential Consequences of Poor Site Health

Slow load times are the enemy of conversions.

Poor performance? You’re losing leads.

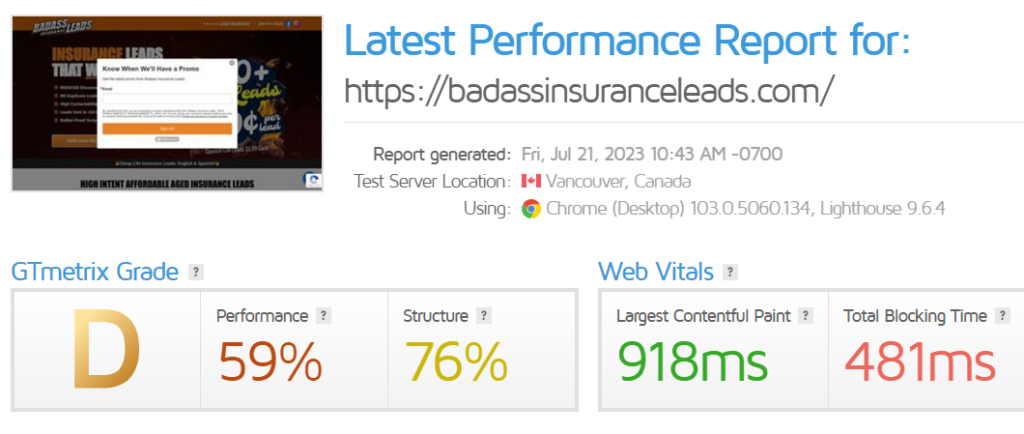

Ensure optimal speed with regular checks using tools like GTMetrix.com

As you can see from the analysis of our own website, we have to work on some of the loadtime due to some of the large images on our website.

Remember: Your online presence and the User Expereince (UX) matters.

Email Marketing: A Powerhouse Strategy

Have you ever considered the power of email marketing?

You definitely should. We think it’s so important that we created a whole section of the post to it!

Why?

Because it’s an incredibly effective tool for reaching both your customers and prospects.

Different Formats in Email Marketing

Gone are the days of sending boring, generic emails.

There are various formats you can use to make your emails more engaging:

- Create newsletters to keep your audience informed.

- Send retargeting emails to re-engage potential customers.

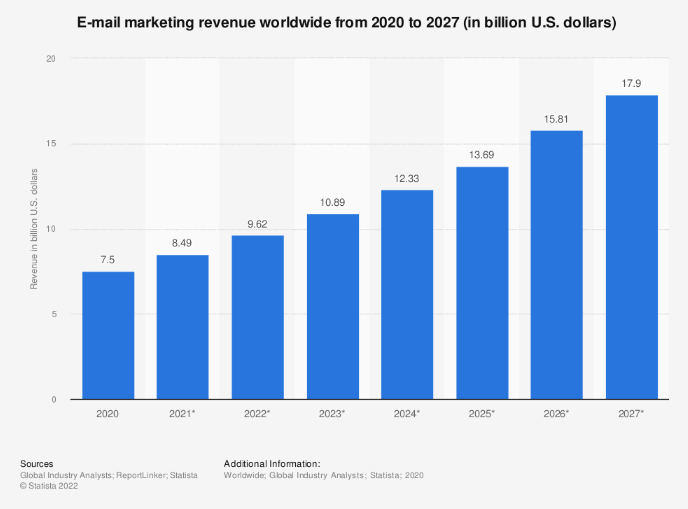

Email is so important that a recent study by Hubspot showed that 37% of brands are increasing their email marketingn budget in 2023!

Email marketing revenue is also slated to reach almost 11 billion by the end of 2023.

For newer agents or brokers that don’t have much experience with email marketing, I suggest looking at a tool called Constant Contact. It’s super easy to use and their pricing is cheap especially if you dont have a large email list already.

BONUS: Ever heard of Zapier? It’s a connector tool that allows you to connect 2 (or more) of thousands of the top softwares out there. Check out Zapier’s top picks here.

FAQs in Relation to Online Tools for Insurance Agents

What tools do insurance companies use?

Insurance companies utilize various digital tools like agency management systems (AMS), customer relationship management (CRM) software, quoting and lead generation tools, email marketing platforms, and website monitoring services.

What is an advantage of using an online insurance company agent?

Online insurance agents offer convenience with 24/7 availability. They provide quick quotes, easy policy comparison, streamlined application processes and instant coverage decisions through their digital platforms.

What are online insurance aggregators?

Online insurance aggregators are websites that compile information from various insurers to help consumers compare policies on price, features and benefits before making a purchase decision.

How to market insurance products online?

Insurance products can be marketed online through targeted email campaigns, social media advertising, content marketing via blogs or articles, SEO strategies for better visibility in search results, and utilizing digital ad platforms.

Conclusion

Insurance agents are no longer tied to traditional methods.

The digital age has brought a wave of online tools for insurance agents, revolutionizing the industry and enhancing client satisfaction.

If you’re looking for leads for your life insurance business, check out some of our packages here.