Output vs Income Tracker for Insurance Agents

Hey guys, how are you doing? Laz Barath with you, family first life, American Capital life. I hope you guys are all doing well, making a lot of money, booking those appointments, buying those leads. I wanted to talk about something real quick. That is super important, but also extremely simple.

How Does it Work?

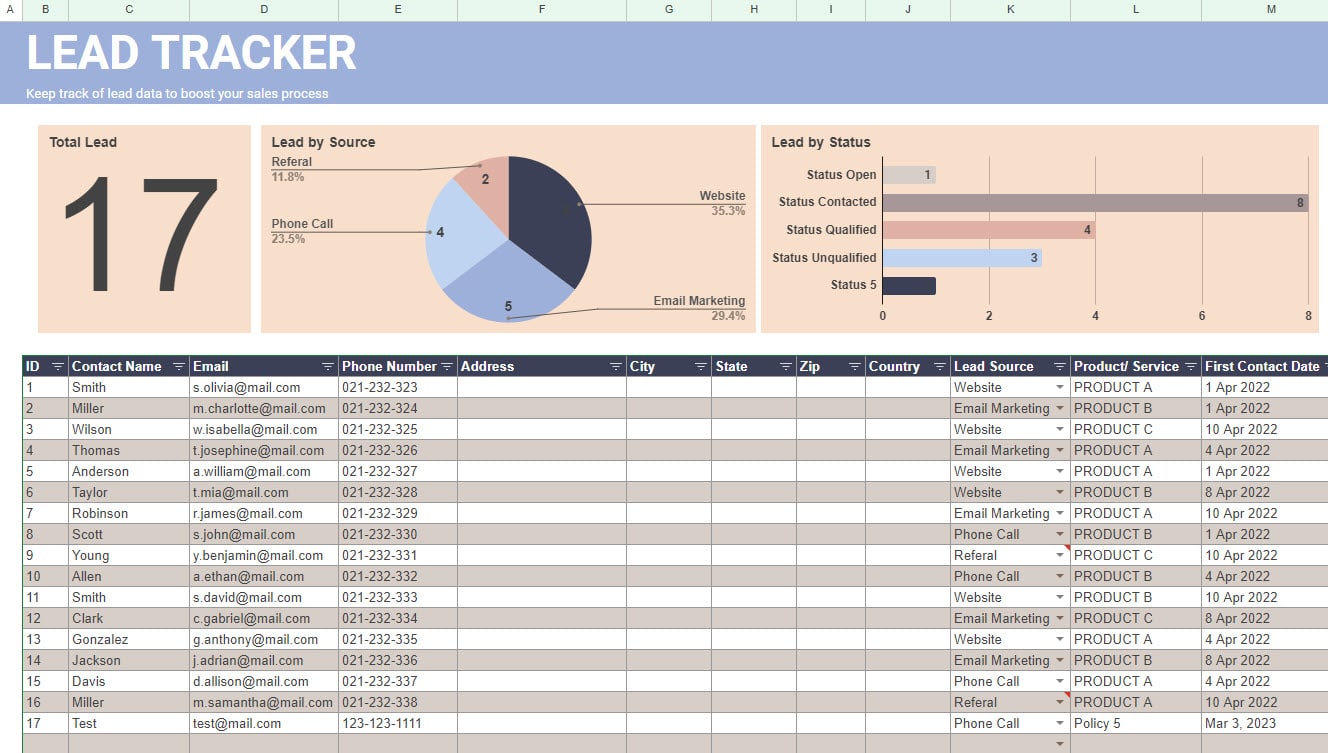

With this here, this is called the output income sheet and what you’ll do is in the beginning of every week, you’ll put down here. So this is just an example of one of my weeks, and this wasn’t even really a good week, to be honest with you. I definitely was slacking and I didn’t even realize it, because I had a 30 something thousand month in October, but this particular week was definitely one of my slower weeks. So it says here October eighth to October 14th. Now on here it’s broken down, so you got your Thursday to Wednesday and then you’ll see leads dialed.

Buy Aged Life Insurance Leads Here

So what I like to do in a week is I like to have a good hundred leads. You want a hundred leads that I could really work and I could dial three times and make enough appointments so I could do my run. So here on Thursday, I dialed 50 leads. The amount of hours I dialed that day was only three hours. Now, what I like to do on my dial days is after I dial and book my appointments, I use that day to do my follow-ups. When my customers from the day before or a couple of days before I reach out to them and let them know that they were approved and just follow up with customers very important.

So now over here, field appointment hours. So that Friday I put 10 hours and I included even driving time, and from the time I left my house that day, which was probably eight o’clock in the morning, came back around six o’clock. So I just put 10 hours, which includes everything.

Over here on Monday, I had 80 leads that I was dialing. I did for five hours altogether. So a little bit more, I did one hour worth of follow up. And then you see on Tuesday I worked seven hours in the field and five hours on Wednesday. So now on this line, over here, total dials hour for the week was eight, which is really nothing. I probably should have done eight hours per dial day. Total field hours was 22. Now this here weekly lead plan a leads. So this is another thing too, because I was talking to this agent and he says, “Well, I don’t really even remember which leads work better than others.” And it’s super important. Number one, to diversify, not just use the same lead source, but to keep track of it. Okay.

So now over here I had 20 fresh leads, 30 CRM leads and 50 aged leads. And then I wrote over here, the sources. So Dirt Cheap Life Leads, 20 of them. Instant internet life leads, I had 30 of them and age Dirt Cheap Life Leads I had 50 of them. So now I looked over here, number of appointments total for the week was 14, which I was new at this time. And, still I’m guilty of not working, I mean, we can all work harder than we do, but 14 appointments for a week is nothing. Anything under 15 appointments is kind of a danger zone. You should definitely be at least 15 or more. 14 appointments really? This is a part-time schedule right here. So number of sales nine, total AP was 78 54. Number of follow-ups that I did within that week was eight follow-ups. And then now, when I see the totals here, so total deposited commission was $5,890 and 50 cents, which still is not bad.

Read More! Aged Life Leads vs Fresh Life Leads

I took half of that. So I divided that in half. So 29 hundred… Or $2,945 and 25 cents. And that stayed in my business account, and this is super important. You want to have two separate accounts. You want to make sure that you have your business account, and then you want to have your personal account, because the reality is, if you don’t separate the two and you don’t put your business above you.

So remember you’re your own boss, but you’re also your own employee. So you have to put your business on top of yourself and your business costs and expenses and profits. Because if you do that, then it’s your business that’s continuously investing in you and paying you and buying leads and having money set aside for taxes and whatever expenses you may incur, just like any business. So, I have half in the business account, the other half is what I pay myself. So when I take 29 hundred… 2945,25 and I divide it by 33 hours, it’s still coming out of the $89 and 25 cents an hour. It’s not too bad.

Now when I look back and I think, well, of all the weeks in October, this was my worst one. There’s a reason for it, and the reason is I just didn’t work enough. And it says it right here and it makes it easy for you to see, okay, well, if I’m making $89 an hour in 33 hours in a week, and I want to make more money, what do I do? I work more hours. And if you work more hours clearly, and it doesn’t take a mathematician to figure it out, you’ll make more money.