The FCC’s New Rulings for Explicit Consent: A Legal Breakdown

In the ever-evolving landscape of lead generation and telemarketing, staying compliant with the Telephone Consumer Protection Act (TCPA) is paramount. The Federal Communications Commission (FCC) recently issued a new order that significantly impacts how lead generators and buyers operate, making it crucial for businesses to understand and adapt to these changes.

Let’s break down the key aspects of TCPA compliance for lead generation in light of the FCC’s new order:

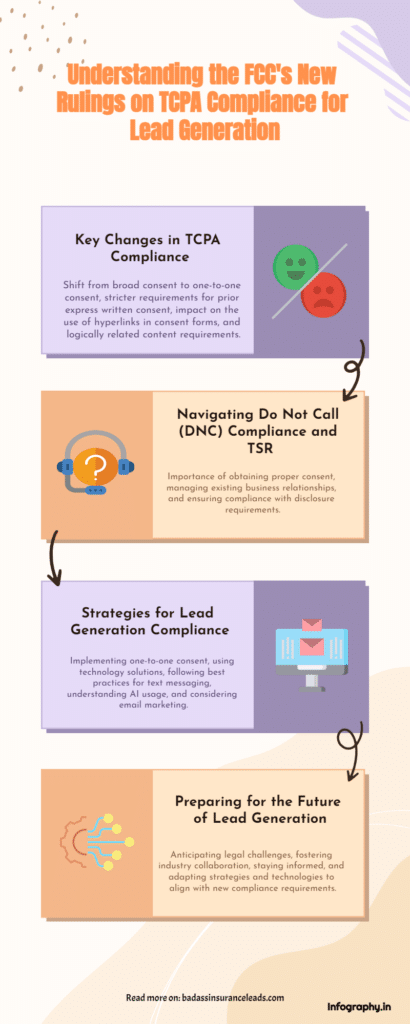

Key Changes in TCPA Compliance for Lead Generation

The FCC’s order introduces several significant changes that lead generators and buyers must be aware of:

- Shift from broad consent to one-to-one consent: Lead forms must now obtain explicit consent for each specific seller that will contact the consumer, rather than relying on broad, multi-seller consent. So, for example, Badass Insurance Leads will need to be listed as one of the buyers of the insurance lead data.

- Stricter requirements for prior express written consent: The new rules tighten the standards for obtaining proper consent from consumers before initiating telemarketing calls or text messages.

- Impact on the use of hyperlinks and multiple sellers in consent forms: The use of hyperlinks to extensive lists of potential sellers is no longer sufficient. Consent forms must clearly identify each seller individually.

- Logically and topically related content requirements: The content on the lead generation website must be logically and topically related to the products or services being offered by the sellers contacting the consumer.

Navigating Do Not Call (DNC) Compliance and Telemarketing Sales Rule (TSR)

In addition to the TCPA, lead generators and buyers must also navigate compliance with the Do Not Call (DNC) registry and the Telemarketing Sales Rule (TSR). Key considerations include:

- Obtaining proper consent for calling consumers on the DNC list

- Managing existing business relationships (EBRs) under the new rules

- Ensuring compliance with the TSR’s requirements for disclosures, record-keeping, and other practices

Strategies for Lead Generation Compliance

To adapt to the new TCPA compliance landscape, lead generators and buyers should consider the following strategies:

- Implementing one-to-one consent in lead generation forms: Redesign lead forms to obtain explicit consent for each individual seller that will contact the consumer.

- Utilizing technology solutions for TCPA compliance: Adopt technologies that automate consent management, record-keeping, and compliance monitoring.

- Best practices for text messaging compliance for lead generation: Follow industry best practices for obtaining consent, managing opt-outs, and sending compliant text messages.

- Navigating AI and pre-recorded messages in lead generation: Understand the compliance requirements for using artificial intelligence and pre-recorded messages in telemarketing.

- Leveraging email marketing as an alternative to telemarketing: Explore email marketing as a compliant alternative or supplement to telemarketing efforts.

Preparing for the Future of Lead Generation

As the lead generation industry adapts to the new TCPA compliance requirements, businesses should also prepare for potential challenges and opportunities:

- Anticipate an increase in lawsuits and legal challenges as the new rules are implemented and enforced

- Foster collaboration and education within the industry to share best practices and navigate compliance together

- Stay informed about potential appeals and reconsiderations of the FCC order

- Adapt lead generation strategies and technologies to align with the new compliance landscape

FAQ (Frequently Asked Questions)

What is the timeline for implementing the new TCPA compliance requirements?

The FCC has provided a one-year timeframe from the date the order is published in the Federal Register for businesses to come into compliance with the new rules. This is expected to be around January 2025.

Can lead generators still use pre-checked consent boxes on their forms?

No, the new rules require consumers to actively provide their consent by checking a box or taking a similar affirmative action. Pre-checked boxes are no longer compliant.

How can lead generators and buyers prove they obtained proper consent under the new rules?

Maintaining detailed records of consent, including the date, time, and method of consent, as well as the specific language used in the consent request, is crucial. Technology solutions can help automate this process and ensure proper record-keeping.

Are there any exceptions to the one-to-one consent requirement?

While the new rules generally require one-to-one consent, there may be limited exceptions for certain types of multi-seller consent, such as when sellers are closely related or offer complementary products. However, these situations should be carefully evaluated with legal counsel.

The FCC’s new order on TCPA compliance for lead generation presents significant challenges and opportunities for businesses operating in this space. By understanding the key changes, implementing effective compliance strategies, and staying informed about industry developments, lead generators and buyers can navigate this new landscape successfully.

Embracing technology solutions, collaborating with industry partners, and prioritizing consumer privacy and consent will be essential in the months and years ahead. As the lead generation industry adapts and evolves, those who prioritize compliance and innovation will be best positioned to thrive in the new era of TCPA compliance.

How will this affect the aged data industry?

We aren’t sure yet. We think it will just make the cost of the leads you purchase go up since supply will gradually dwindle then stableize. In the upcoming weeks, we are going to release a large FAQ page dedicated to how this will affect agead insurance leads. Stay tuned! (make sure youre on our email list via the popup that comes up on our site)