Life Insurance Sales: Challenges, Tips, and Career Prospects

Embarking on a career in life insurance sales can be both rewarding and challenging.

While the industry offers abundant job opportunities and high commission rates, it also presents unique obstacles that agents must overcome to succeed.

This blog dives into the realm of life insurance sales, exploring its advantages and disadvantages while furnishing valuable advice for success.

Top Challenges of a Career in Life Insurance Sales

Selling life insurance is notoriously difficult, with many agents burning out within their first year. The challenges include commission-based pay, the effort required for customer acquisition, and the complicated sales process that involves discussing sensitive topics like mortality.

Facing Commission-Based Pay Structure Head-On

Most life insurance companies classify their agents as independent contractors without base salaries or benefits.

This means that an agent’s earnings are entirely dependent on successful sales, which can lead to financial instability during slow periods or when starting out in the industry.

Understanding how commissions work will help you navigate this challenge more effectively.

Tackling Customer Acquisition Efforts Like a Pro

Finding qualified leads for potential clients is challenging due to fierce competition among agents. Cold-calling and door-knocking are still common methods used by agents but require perseverance and thick skin to succeed amidst rejections from uninterested prospects.

Utilizing aged insurance leads services like Badass Insurance Leads can give you an edge over your competitors while saving time and energy spent on traditional prospecting methods.

Navigating the Difficult Sales Process Smoothly

Convincing people about the importance of having a life insurance policy can be hard since it requires addressing uncomfortable subjects like death while creating urgency around making immediate decisions.

Agents must develop strong communication skills along with empathy towards client concerns during this process. Adopting habits of highly effective life insurance agents can help you overcome these obstacles and close more deals.

Embracing Continuous Learning and Adaptation

The life insurance industry is constantly evolving, with new products, regulations, and market trends emerging regularly. Staying informed about these changes will allow you to adapt your sales approach accordingly and stay ahead in the game.

Following organizations like the National Association of Insurance Commissioners (NAIC) can keep you updated on important industry news and developments.

Key Takeaway:

Life insurance sales is a challenging career due to the commission-based pay structure, customer acquisition efforts, and complicated sales process.

Pros and Cons of Selling Life Insurance

Selling life insurance can be a thrilling rollercoaster ride with its ups and downs. But hey, why not enjoy a bit of an adrenaline rush?

Abundant Job Opportunities in Life Insurance Sales

The good news is that there’s no shortage of life insurance jobs. So, if you’re eager to get into the life insurance business, there’s plenty of opportunity waiting for you.

High Commission Rates Compared to Other Industries

Show me the money. Life insurance sales offer high commission rates, which means your hard work can pay off big time.

Passive Income Through Policy Renewals

Riding the wave of passive income is possible through policy renewals. Keep those clients happy, and watch the money roll in even when you’re not actively selling.

Tough Competition Ahead: Brace Yourself.

The flip side? You’ll face fierce competition from other agents hungry for success. It’s survival of the fittest out here.

Clients’ Hesitation: Addressing Mortality Isn’t Fun (But Necessary)

No one likes talking about death, but it’s part of selling life insurance policies. Be prepared to navigate these sensitive conversations with empathy and finesse.

Action Steps:

- Research the life insurance industry to understand market trends and opportunities.

- Develop a thick skin for dealing with rejections and competition.

- Hone your communication skills to address sensitive topics effectively.

Bonus Tip: Stay updated on life insurance industry news, so you’re always in the know about changes that could impact your sales strategy. Knowledge is power.

Commission-Based Pay Structure Tips

For many, the lack of a base salary or benefits can be an arduous challenge to overcome. In the life insurance industry, agents are often classified as independent contractors, and their earnings depend solely on successful sales. This means that during slow periods or when starting out in the business, financial instability is your unwanted sidekick. But fear not. You can tackle this challenge by following these actionable steps:

- Create a Financial Cushion:

- Before diving into life insurance sales full-time, save up enough money to cover living expenses for at least six months. This will help you stay focused on building your client base without stressing about bills.

- Diversify Your Income Streams:

- If possible, maintain other sources of income while working as an agent. This could include part-time jobs or freelance work that complements your schedule and skillset.

- Set Realistic Goals:

- Create achievable short-term goals with specific targets (e.g., number of clients per month) and track progress regularly. Adjusting expectations based on actual performance helps avoid disappointment and burnout from chasing unrealistic dreams.

- Budget Like a Pro:

- To manage finances effectively during commission-based pay fluctuations, create a detailed budget plan that accounts for variable income levels. Allocate funds wisely between essential expenses, savings, and investments.

Remember, financial stability in life insurance sales is achievable with proper planning and perseverance. Prepare yourself for the difficulties of a remuneration model based on commissions by taking these steps.

Customer Acquisition Efforts

Selling life insurance is a battlefield, and finding qualified leads feels like searching for a needle in a haystack.

Cold-calling and door-knocking are old-school methods that are still alive and kicking. But to succeed with these tactics, you need to develop an unbreakable spirit amidst countless rejections from disinterested prospects. Master cold calling techniques, refine your pitch, and learn how to handle objections like a pro.

Make the most of digital media by taking advantage of networking sites such as LinkedIn and Facebook to reach out to prospective customers. Use platforms like LinkedIn or Facebook to connect with potential clients.

Create informative content that showcases your expertise, engage in relevant online communities by answering questions and providing value without being overly promotional, and utilize paid advertising options for targeted lead generation campaigns.

Email marketing is another effective way to generate leads and nurture relationships with prospects. Craft personalized emails that address recipients’ needs while highlighting the benefits of life insurance policies.

Your existing clients can be your best source of new business. Create a system of incentives for customers to promote your services by referring others.

In the end, it’s all about perseverance and adaptability – experiment with different strategies until you find what works best for you in this ruthless life insurance sales game.

Overcoming Difficult Sales Process

Selling life insurance is no walk in the park, but with a few key strategies, you can master the art of closing deals and addressing sensitive topics.

We recommend this book below if you’re just getting started in insurance sales.

Emphasize Value Over Cost

Instead of focusing on policy premiums, highlight the peace of mind and financial security that your clients will gain from having coverage in place.

Create Urgency Without Fear Tactics

Avoid using scare tactics to push clients into purchasing policies. Instead, emphasize how securing coverage now can save them money and provide long-term benefits for their loved ones. Life Happens, a nonprofit organization dedicated to educating consumers about life insurance, offers valuable resources to help agents communicate these points effectively.

Tailor Your Approach Based on Client Needs

Understand each client’s unique situation and customize your sales pitch accordingly. By demonstrating genuine concern for their well-being, you’ll build trust while presenting relevant solutions tailored specifically for them.

Educate Clients About Policy Options

Clients may be hesitant due to misconceptions or lack of understanding about life insurance products. Take time to educate them on different policy types, such as term vs whole life policies so they can make informed decisions based on their needs and budget constraints.

Leverage Personal Stories & Testimonials

Share real-life examples of how life insurance has made a positive impact on families during difficult times. Personal stories and testimonials can be powerful tools in illustrating the importance of having coverage.

Develop Strong Communication & Listening Skills

Active listening is key to understanding your clients’ concerns and addressing them effectively. Maintain open lines of communication, ask probing questions, and listen carefully to their responses before offering solutions that align with their needs.

Persistence Pays Off

Selling life insurance requires determination and resilience amidst rejections. Stay persistent, follow up with prospects regularly, and remember that every “no” brings you one step closer to a “yes.”

Key Takeaway:

To successfully sell life insurance, emphasize the value of coverage and tailor your approach to each client’s needs.

Tips for Success in Life Insurance Sales

Develop Strong Customer Service Skills

One of the keys to success in life insurance sales is making your clients feel valued and heard. To effectively meet customer needs, focus on honing your listening skills, displaying empathy and providing timely responses. Check out this guide on improving customer service for more tips.

Focus on Solving Clients’ Problems

Remember, you’re not just selling a product – you’re selling a solution to your clients’ problems. Take the time to dig deep into their needs and concerns, and tailor your policies to address those issues. Here’s an article about the art of problem-solving selling to help you get started.

Build a Professional Network for Support and Growth

As the saying goes, you’re only as strong as your network. Creating meaningful connections with colleagues in the industry, such as agents, brokers, and financial planners, can be invaluable for professional growth. Learn how to build a killer professional network from this networking guide.

Make a Lasting Professional Impression

First impressions matter, but so do lasting ones. Create a memorable experience for your clients by being genuine, reliable, and consistent. Read this article on creating lasting impressions to learn more.

Play the Long Game with Client Relationships

Don’t be a one-hit-wonder agent. Nurture long-term relationships with your clients to ensure repeat business and referrals. Discover how to maintain strong client connections in this long-term relationship building guide.

Bonus Tip: Stay updated on industry trends and market changes – knowledge is power. Subscribe to insurance news sites like Insurance Journal, attend conferences, or join professional associations.

Now that you have these tips, it’s time to put them into action and conquer life insurance sales.

Seek Out Support and Mentorship

Find Experienced Professionals to Guide You

Mentors can provide invaluable advice, support, and connections in the industry. Reach out to successful life insurance agents or join industry associations for networking opportunities. Joining NAILBA is a great way to network and gain insight into the life insurance industry.

Informed Decision-Making is Crucial

Weigh Pros and Cons Before Committing to a Career Path

Analyze your personal goals, understand the challenges of life insurance sales, and make an informed decision about whether this profession is right for you.

FAQs in Relation to Life Insurance Sales

The toughest part of selling life insurance?

Overcoming clients’ reluctance to discuss their mortality and convincing them of the policy’s value can be a challenge, but building trust, addressing objections, and communicating benefits effectively are crucial skills for success. Check out Investopedia for insights into common challenges faced by insurance agents.

Is selling life insurance profitable?

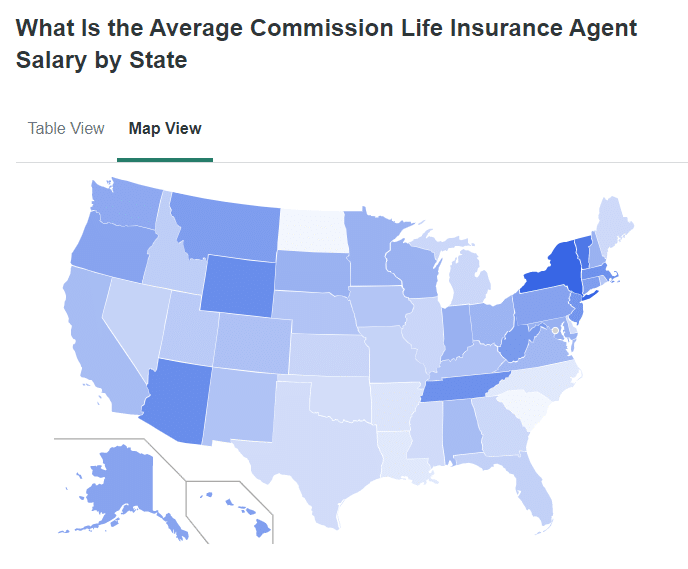

Yes, selling life insurance can be highly profitable due to high commission rates and passive income through policy renewals, but it depends on an agent’s ability to acquire new clients and maintain existing relationships. Learn more about life insurance agent earnings.

How can I succeed in life insurance sales?

To achieve success in life insurance sales, focus on solving clients’ problems with tailored solutions, provide exceptional customer service, develop a strong professional network, continually improve your product knowledge, and nurture long-term client relationships. Explore these tips for selling life insurance.

What should I know before selling a life insurance policy?

Before selling a life insurance policy, understand different types of policies, underwriting requirements, riders/add-ons available for customization, and compliance regulations within the industry. Familiarize yourself with life insurance basics from the National Association of Insurance Commissioners and consider consulting with a financial advisor.