Life insurance leads

Whether you’re a seasoned agent or just starting, this guide is packed with actionable insights, expert tips, and real-world examples to help you master lead generation in today’s competitive market.

Prepare to embark on a journey that will transform how you approach life insurance sales and lead generation. Let’s discover the secrets to success in this dynamic field!

What are Life Insurance Leads?

Life insurance leads represent potential clients interested in purchasing life insurance policies. These leads are crucial in the insurance industry, providing agents with opportunities to expand their client base and increase sales. Identifying and nurturing these leads is vital to sustaining and growing an insurance business in today’s competitive landscape.

Who is This Guide For?

The guide is ideal for agents at all levels, whether entering the field or looking to enhance lead-generation strategies. More specifically:

- New Insurance Agents: This guide serves as an essential primer for those just starting their career in the insurance industry, introducing them to the fundamental concepts and strategies of life insurance lead generation.

- Experienced Insurance Agents: Seasoned professionals will find advanced techniques and insights to refine and enhance their lead generation strategies, ensuring they stay competitive in a dynamic market.

- Insurance Brokers: This guide is invaluable for brokers who intermediate between clients and insurance companies. It offers them effective tactics to increase their client base and success rate in acquiring life insurance leads.

- Sales Managers in Insurance Companies: Sales managers responsible for guiding and training their teams can utilize this guide to develop comprehensive training modules and strategic approaches for their teams in lead generation.

- Independent Insurance Consultants: For consultants who provide advice on insurance policies, this guide offers a wealth of information to help them better understand the market dynamics and effectively advise their clients on lead generation strategies.

- Marketing Professionals in the Insurance Sector: Marketing experts within the insurance industry can leverage this guide to align their marketing strategies with proven lead generation tactics, enhancing the effectiveness of their campaigns.

- Insurance Agency Owners: Owners of insurance agencies can use this guide to understand the latest trends and effective strategies in life insurance lead generation, helping them to grow their business and stay ahead in the market.

Life Insurance Leads: Types and Customer Journey

Exploring the Different Types of Life Insurance Leads

Life insurance leads can be categorized based on policy types, such as term life, whole life, and universal life insurance. Each type attracts different demographics and necessitates distinct marketing approaches. Understanding these categories helps agents effectively tailor their strategies to target the right audience.

- Term Life Insurance Leads: Individuals seeking coverage for a specific period, often chosen for affordability and simplicity.

- Whole Life Insurance Leads: Prospects interested in lifelong coverage with an added savings component, appealing to those seeking long-term financial planning.

- Universal Life Insurance Leads: Clients seeking flexible premiums and coverage suitable for those desiring adjustable life insurance policies.

- Variable Life Insurance Leads: Leads interested in policies with an investment component, where cash value is tied to investment performance.

- Indexed Universal Life Insurance Leads: Prospects attracted to life coverage policies and a cash value component tied to a market index.

- Survivorship Life Insurance Leads: Couples or partners interested in a policy that covers two lives, with benefits payable after the second person passes away.

- Final Expense/Burial Insurance Leads: Individuals seeking to cover end-of-life expenses, typically appealing to older demographics.

- Group Life Insurance Leads: Employers or organizations looking to provide their employees or members life insurance benefits.

- Convertible Term Life Insurance Leads: Clients interested in term policies that offer the option to convert to permanent insurance without additional medical underwriting.

Then you have normally 2 types of the leads we just mentioned. Aged or Fresh leads.

- Aged Leads: Older leads that were generated some time ago but have yet to be pursued or converted. They can range anywhere from a few days to 12 months+.

- Fresh Leads: These are normally real-time leads that come to the agent via an email, SMS or through a connection with a CRM. They are generated from online ads, organic content marketing and somtimes direct mail. See our post here on Aged vs Fresh Leads.

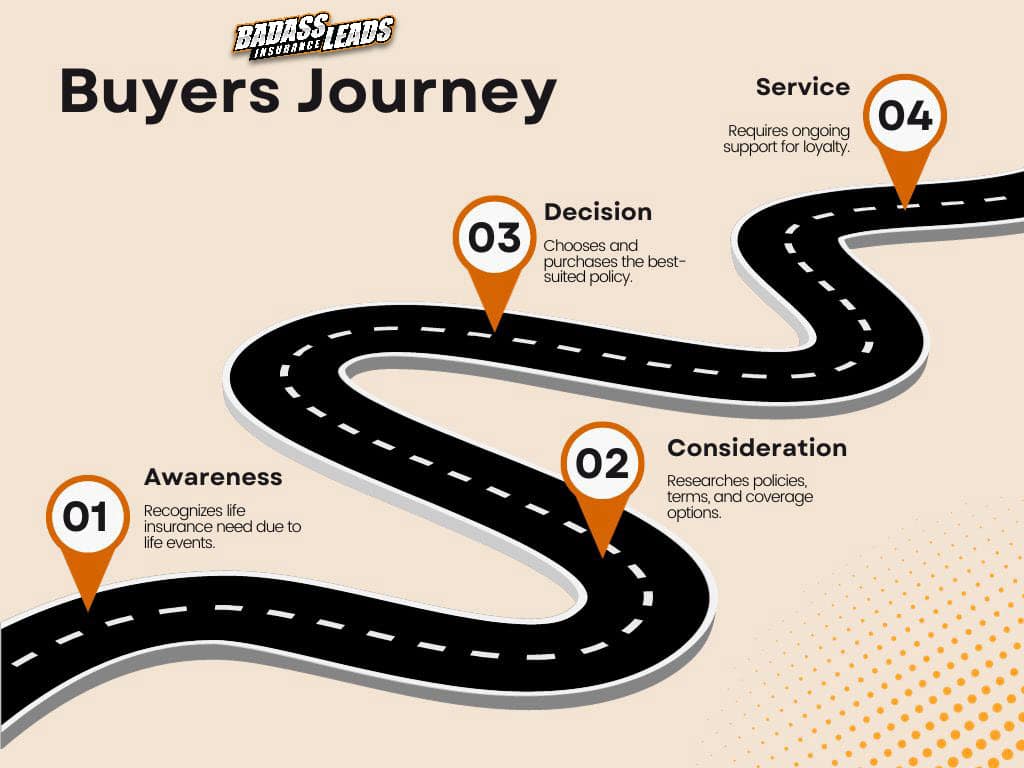

The Buyer’s Journey for Life Insurance: A Detailed Look

The journey of a life insurance customer usually involves awareness, consideration, and decision stages. By comprehending this journey, agents can create more targeted and effective marketing strategies, guiding potential clients smoothly from initial awareness to the final purchase decision.

- Awareness Stage: The potential client recognizes a need for life insurance, often triggered by life events like marriage, parenthood, or career advancement.

- Consideration Stage: The client actively researches different policies, comparing terms, coverage options, and insurers, seeking information that aligns with their specific needs.

- Decision Stage: After evaluating options, the client selects a policy that best fits their requirements and proceeds to purchase it, completing the journey.

- Service/Retention Stage: Post-purchase, life insurance clients need ongoing support and engagement for loyalty and advocacy.

Identifying Potential Life Insurance Customers

Successful lead generation starts with identifying potential customers. This involves understanding the market, recognizing the needs and preferences of different demographics, and developing strategies to connect with these potential clients meaningfully.

Demographic Insights: Understanding Customer Needs in Life Insurance

Demographics play a crucial role in life insurance lead generation. Agents can create more personalized and compelling marketing messages by understanding age, income level, family status, and health concerns.

- Example Demographic Strategy: For a demographic such as young professionals in their 30s, an agent might focus on life insurance as a financial planning tool. Marketing materials could emphasize the benefits of securing life insurance early, such as lower premiums and long-term financial security. Tailored emails or social media campaigns could highlight scenarios relevant to this age group, like providing for young families or covering mortgage obligations.

- Example Strategy for Retirees: Agents might focus on direct mail campaigns and community seminars when targeting retirees. Messaging could center on the benefits of life insurance for estate planning and leaving a legacy. Personalized consultations could be offered to discuss individual needs, and materials might include guides on navigating life insurance choices post-retirement.

Many times, it’s also good to create a breakdown of your ideal buyer personas. This way, you can market and sell the right way, at the right time to the right people. Here’s a cool tool from Hubspot to help you create those persona profiles.

Current Trends Impacting Life Insurance Lead Generation

In a world where change is the only constant, staying in tune with the latest trends in life insurance is more than a necessity – it’s a strategic advantage. This section delves into the pivotal trends shaping the life insurance landscape in 2023 and beyond. From the growing awareness of personal risk and security to the transformative role of technology, these trends are reshaping how life insurance products are marketed and consumed. Understanding these shifts is crucial for agents aiming to keep up and lead the way in an increasingly dynamic market. Let’s explore these key trends and their impact on lead generation.

2 Top Life Insurance Trends in 2023

- Increased Awareness of Personal Risk and Security

The post-pandemic era has heightened awareness of personal health and financial security. The aging population, particularly in developing economies, contributes to this trend, increasing demand for life insurance products. Read more on McKinsey - Technology’s Role in Life Insurance

The life insurance sector increasingly leverages technology, with IT spending growing significantly. This investment paves the way for enhanced data analysis and digital customer engagement, offering insurers new ways to engage and operate efficiently. Read more on McKinsey

What tools can I use to track trends?

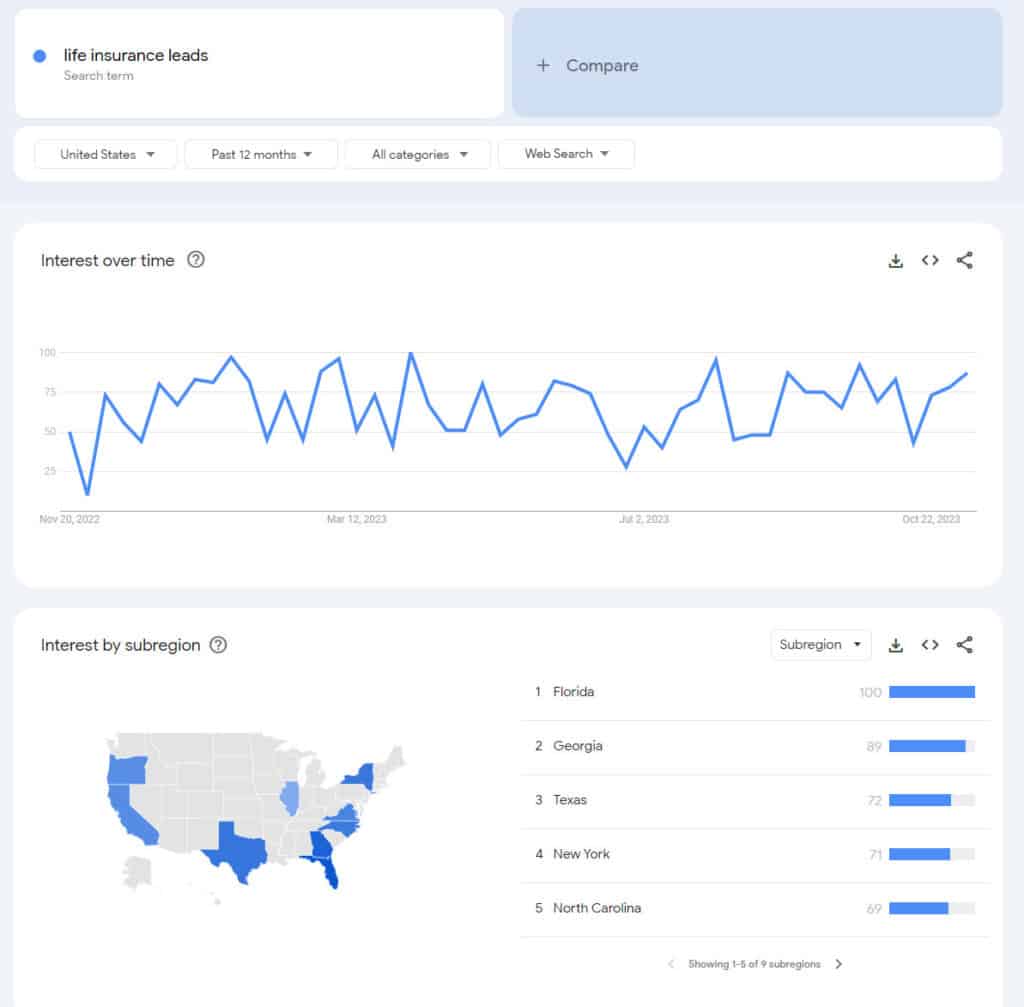

Google Trends

We recommend a couple. Our first pick is Google Trends. It’s free and is updated on a daily basis. It will show you what geographic areas / states are searching for a specific type of insurance so you can potentially target that area more aggressively with your marketing efforts.

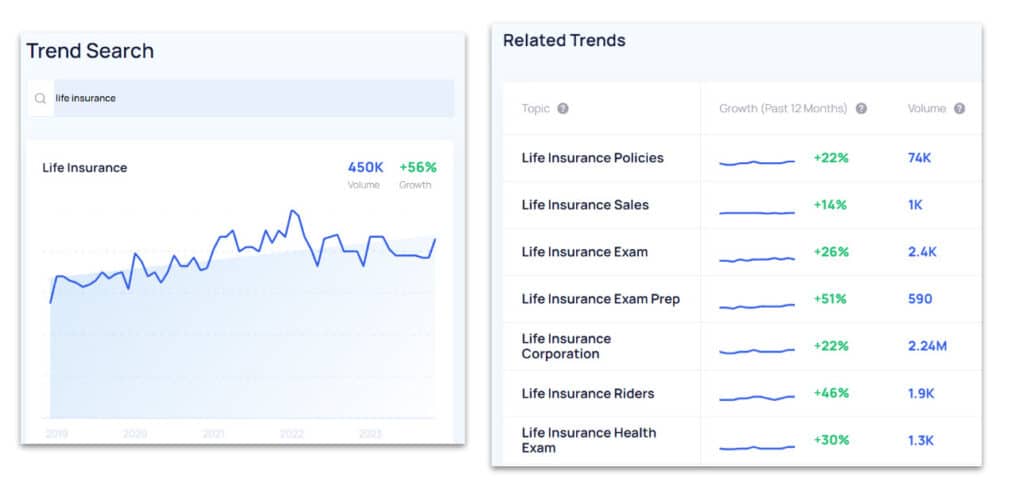

ExplodingTopics.com

Similar to Google Trends, this tool is complimentary to Google’s data. It gives you trending topics that you could use for blog posts or social media. You may also pickup on something before your competition gets ahold of it, thus allowing you to ride that trending wave. Learn more about Exploding Topics here.

Leveraging Data and Analytics for Enhanced Lead Generation

In life insurance, data and analytics are not just tools; they are game-changers. This section unveils how leveraging these assets can revolutionize your lead generation approach. Dive into the world of predictive analytics and customer segmentation to discover how you can harness data to identify potential clients and tailor your marketing strategies. By tapping into the power of data, you’re not just following leads – you’re predicting and crafting them.

Examples of Leveraging Data and Analytics in Lead Generation

- Predictive Analytics for Identifying Potential Clients: Using predictive analytics, agents can analyze patterns in existing customer data to identify potential clients who are more likely to purchase life insurance. This could involve considering factors like age, lifestyle choices, and family history.

One company that we like that helps life insurance agents comb through data to find user intent is ForMotiv

- Customer Segmentation for Tailored Marketing: Agents can create more personalized marketing campaigns by segmenting their customer base using data analytics, for example, targeting different age groups with tailored messages about life insurance products that are more relevant to their life stage and needs.

One of our favorite tools for segmentation is Customer.io. It’s more tapered towards a broker / agency or a team of marketers versus an indpendant agent.

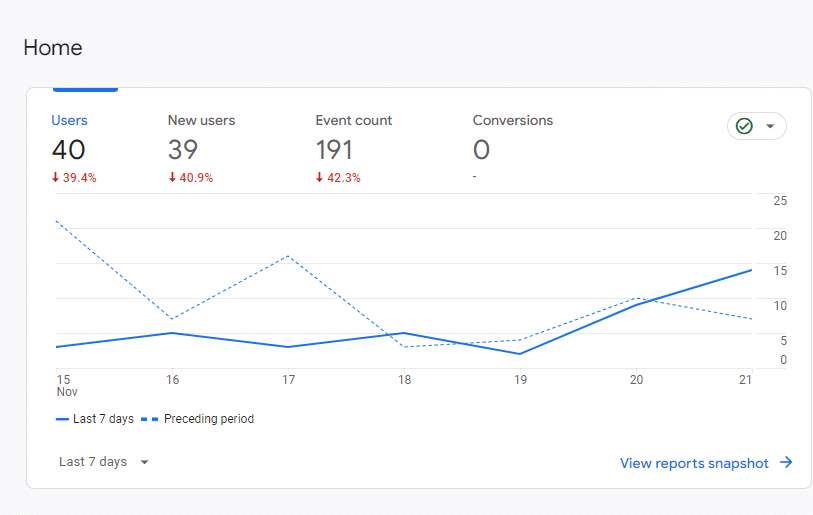

Of course, one of the most basic tools to use, and a free one at that, is Google Analytics 4. Their recent release of their updated platform comes with many different ways to track, segment and report on what’s happening on your insurance company’s website, apps or any social media channel.

Generating Life Insurance Leads

3 Top Lead Generation Strategies

We cover the top 3 ways to start generating life insurance leads. Whether youre a new agent or an experienced broker, mastering these techniques will help you not only generate a ton more leads, but it will help your business flourish over time.

1: Digital Marketing & Social Media: Utilizing SEO, social media, PPC (pay per click) and email marketing to reach a wider audience.

If you don’t have experience doing anything mentioned above, you may want to either focus on 1 tactic or reach out to a marketing agency that specializes in generating leads in the insurance space.

Timeframe: SEO (the organic search results) can take months or years to really see results. While PPC could take as little as hours, depending on when you go live with the ads.

Social Media as a Lead Generation Tool

Social media platforms offer vast opportunities for generating life insurance leads. This section discusses how to use social media channels effectively to reach and engage with potential clients, including tips on content creation, targeting, and community building.

Using Facebook for Life Insurance Lead Generation

- Content Creation: Share informative articles, client testimonials, and infographics about life insurance to educate and engage your audience.

- Targeting: Use Facebook’s ad targeting features to reach specific demographics based on age, interests, and life events like marriage or childbirth.

- Community Building: Create a Facebook group to discuss life insurance topics, fostering a sense of community and trust.

Pay-Per-Click (PPC) Advertising in Life Insurance

PPC advertising can be a highly effective way to generate leads. PPC campaigns, particularly on platforms like Google and Bing, to target potential life insurance clients, discussing strategies for maximizing ROI and conversion rates.

PPC Campaign Example Using Bing

- Keyword Selection: Focus on selecting relevant keywords that potential life insurance clients are likely to use. Include terms specific to life insurance products, targeting both broad and niche audiences.

- Creating Compelling Ads: Develop ads that highlight the unique selling points of your life insurance products. Ensure the ad copy is clear, concise, and includes a strong call-to-action (CTA).

- Targeting and Bid Strategies: Utilize Bing’s targeting options to reach specific demographics, like age groups or individuals in life-changing events. Adjust bids based on performance metrics to maximize ROI.

- Landing Page Optimization: Direct your PPC traffic to optimized landing pages that are relevant to the ad content. Ensure these pages have a clear message and a straightforward path to conversion.

Leveraging LinkedIn for Professional Networking

- Content Strategy: Post thought-leadership articles and industry insights to position yourself as an expert in the life insurance field.

- Networking: Connect with professionals, particularly those in life stages typically considering life insurance, like new parents or homeowners.

- Engagement: Participate in relevant LinkedIn groups, answer questions, and offer valuable insights, establishing credibility and attracting leads.

Email Marketing Campaigns for Nurturing Leads

Email marketing remains a potent tool for lead generation. Here’s an example of how to create compelling email campaigns that resonate with your audience, encourage engagement, and move leads down the sales funnel.

- Segment Your Email List: Categorize recipients based on their behavior and interests.

- Create Personalized Messages: Tailor content to address the specific needs of each segment.

- Mix Educational and Promotional Content: Balance informative articles with offers and promotions.

- Include Clear Calls-to-Action: Guide recipients to the next step, like scheduling a consultation.

- Analyze Campaign Performance: Regularly review open rates, click-through rates, and conversions to refine your approach.

2: Networking and Referrals: Building relationships with clients and other professionals to generate referrals.

This long term strategy is also a long term tactic because you’ll need to brand yourself or your company as a trusted source when porospects are searching for life insurance options.

No matter what city you live in, there is probably a networking event happening where you can mingle or present to tell people about what services you offer.

Onc you’ve built up trust in your geographic area, you’ll start to generate referrals. This is when you should truly nurture and grow those referral partnerships so you’ll continue to have a steady stream of referrals. We’ve seen that referrals from friends, family or past deals close at a much higher percentage.

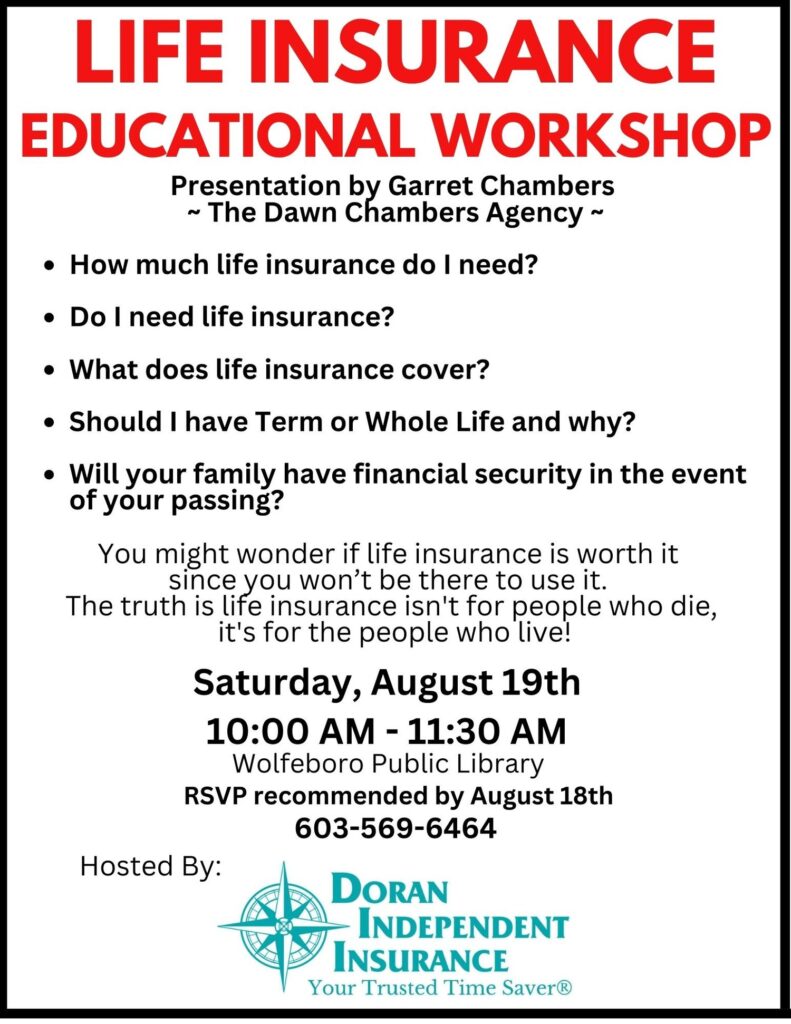

3: Educational Workshops and Seminars: Hosting events to educate potential clients about life insurance, establishing expertise and trust.

Speaking of building trust in your geographic market, this tactic can be very fruitful. After you’ve figured out your ideal persona that you want to target, find out where these people get their trusted information. The demographic may be older so placing ads in newspapers or nicghe magazines could be a good idea to get them to register for your workshoop.

See a sample ad from the Doran Insurance Company.

Comparing Lead Generation Methods: Cost, Effort, and ROI Analysis

A critical aspect of choosing lead generation methods is understanding their cost, effort, and return on investment (ROI). This section compares various methods on these parameters, aiding agents in making informed decisions about which strategies to employ.

| Lead Generation Method | Cost | Effort | ROI |

| Digital Marketing | Moderate to High | Moderate | High (Wide reach and targeting capabilities) |

| Traditional Marketing | High | High | Moderate (Broader audience but less targeted) |

| Networking and Referrals | Low | High (Time-consuming) | High (Strong trust and conversion potential) |

| Educational Workshops | Moderate | High (Preparation required) | Moderate to High (Builds authority and trust) |

| Automated Email Campaigns | Low to Moderate | Moderate (Setup required) | Moderate (Depends on content relevance) |

| Personalized Consultations | Low (Time cost) | High (Personal effort) | High (Effective for client conversion) |

Warm Internet Leads: Nurturing Online Prospects

Warm leads, those who have already shown some interest or engagement, are more likely to convert than cold leads. This section highlights the advantages of warm leads, especially in the digital landscape, where personalized engagement can significantly impact lead nurturing.

3 Top Ways to Nurture

Nurturing online leads is crucial for converting interest into sales. This part of the guide discusses effective strategies for maintaining and developing relationships with potential clients who have interacted with your online content or expressed interest in your services.

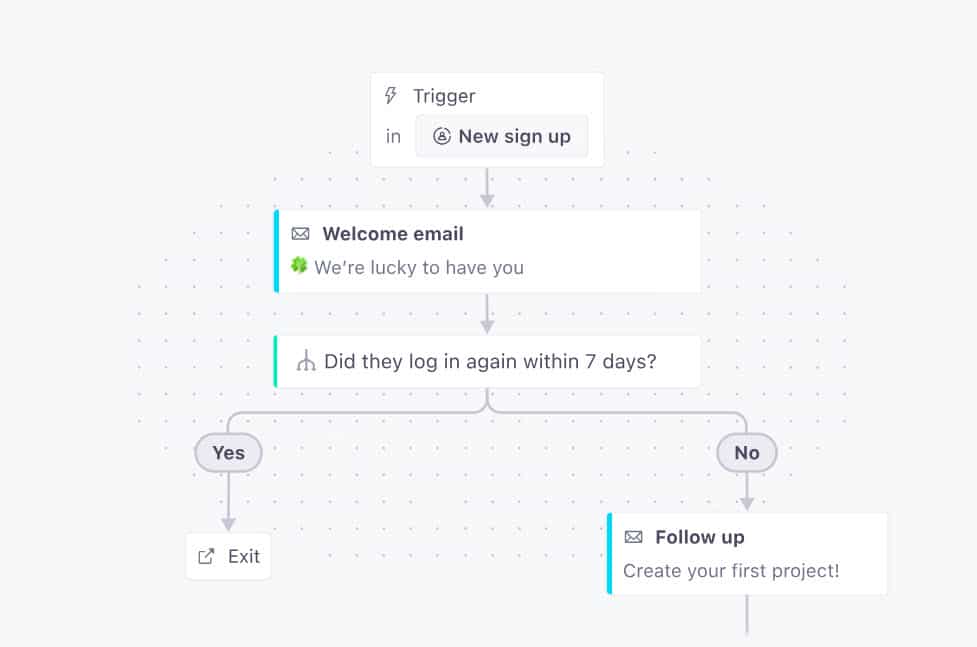

- Targeted Email Nurturing Campaigns: Create a series of automated emails that are triggered once a potential client interacts with your online content. These emails should provide additional information, share customer testimonials, and gradually guide the lead through the decision-making process. (We like Mailchimp email tool as it’s the easiest to use and it integrates with a ton of softwares)

- Personalized Follow-Up via Social Media: Engage with leads who have shown interest via social media by responding to their comments, sending direct messages with tailored advice or offers, and sharing relevant content that aligns with their interests or needs. This personal touch can significantly enhance the relationship-building process.

- Content marketing is a powerful tool for attracting warm leads. Agents can draw potential clients to their services by creating valuable and informative content. This section explores leveraging blogs, articles, videos, and other content forms to build trust and engage with your audience.

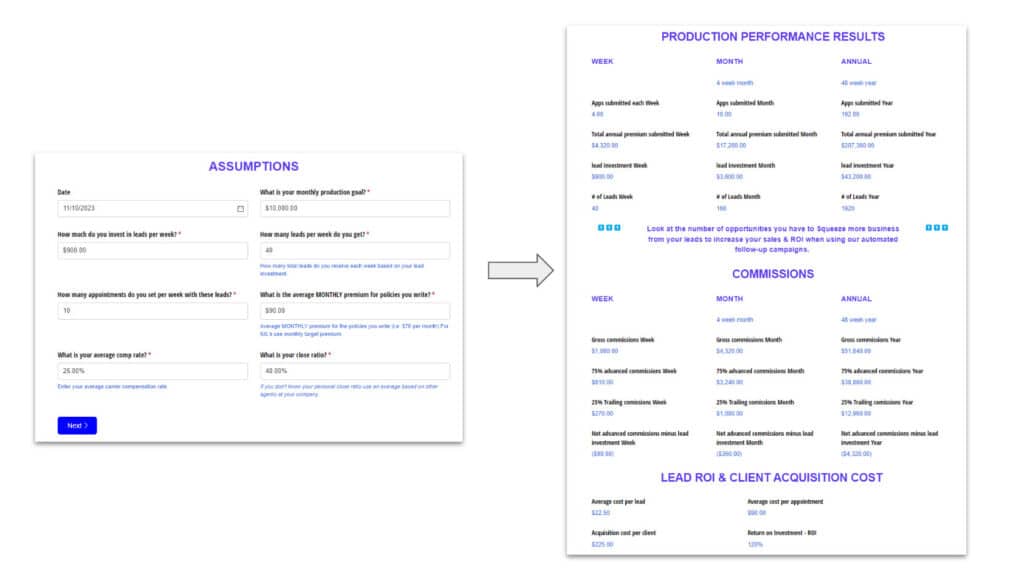

Life Insurance Leads Calculator

Check out this really cool leads & production calculator from our friends at LeadSqueezers. All you have to do is plugin some variables and it spits out some easy to understand results of what kind of output you could potentially see buy selling a specific amount.

Organic Traffic: Search Engine Optimization (SEO)

A well-designed website is essential for generating leads. This section offers best practices for creating a user-friendly, informative, and engaging life insurance website that effectively captures leads organically. Don’t forget these key elements:

- User-Friendly Navigation: Design your website with intuitive navigation and a clear structure to help visitors easily find the information they need.

- Engaging Visuals and Layout: Incorporate professional and relevant images and a clean layout to make the website visually appealing and trustworthy.

- Clear Call-to-Actions (CTAs): Place prominent CTAs throughout the site to guide visitors towards taking actions like getting a quote or contacting an agent.

SEO Strategies for Life Insurance Websites

SEO is critical for ensuring your website is visible to potential clients. Some of the basics of SEO include keyword research, on-page optimization, and building quality backlinks from trusted sources naturally. Enhance the visibility of your website in search engines by implementing these strategies:

- Keyword Research: Focus on identifying and incorporating keywords that potential clients use when searching for life insurance products.

- On-Page Optimization: Optimize page titles, meta descriptions, and header tags with targeted keywords for better search engine visibility.

- Quality Backlinks: Build backlinks from reputable insurance and finance-related websites to enhance your website’s authority and search ranking.

Content Tips for Boosting Organic Reach and Ranking

Content is king in SEO. This section provides practical tips for creating SEO-friendly content that engages readers and improves your website’s organic reach and search engine rankings. To ensure your website’s content is SEO-friendly and engaging for readers, consider these tips:

- Valuable and Informative Content: Create content that addresses common questions and concerns about life insurance, offering real value to your audience.

- Regular Updates: Keep the website’s content fresh and updated to maintain relevance and favorability in search engine rankings.

- Engagement and Shareability: Produce engaging and easily shareable content on social media platforms to increase visibility and organic reach.

Crafting Engaging and Informative Content

Engaging content is a cornerstone of effective lead generation. To effectively engage and educate your audience, your content should be compelling and educational. Some of the most basic and effective ways to present your content are in these formats:

- Storytelling Techniques: Use real-life scenarios and stories to make complex insurance topics relatable and understandable.

- FAQs and How-To Guides: Address common questions and concerns about life insurance through FAQ sections and step-by-step guides. (Don’t know where to start? Simply find out the top 20 questions that your prospects ask about life insurance and create an FAQ section on your website with video and text)

- Interactive Content: Incorporate quizzes or calculators to engage users interactively, helping them understand their life insurance needs. What are some useful tools that your prospects would want to have? Maybe a calculator helping them calculate the costs associated with life insurance premiums?

Effective Content Distribution Channels

Creating great content is just the first step; it also needs to be seen. You’ll need to find the best channels where your prospects are consuming this content. Some of the most effective channels to life insurance related content are as follows:

- Social Media Platforms: Utilize platforms like Facebook, TikTok and LinkedIn to share and promote content, targeting specific demographics.

- Email Newsletters: Send regular newsletters featuring your latest content to keep subscribers informed and engaged. (See some samples from insurancenewsletters.com)

- Collaborations and Guest Blogging: Partner with industry influencers or contribute to popular blogs to reach a wider audience and gain credibility.

Measuring Content Marketing’s Impact on Lead Generation

To understand the effectiveness of your content marketing efforts, it’s essential to measure their impact. You should at least track basic metrics like traffic, number of leads and your conversion rates.

- Traffic and Engagement Metrics: Track website visits, page views, and time spent on pages to gauge interest and engagement levels. Basic tools like Google Analytics can help you with this.

- Lead Generation Metrics: Monitor the number of leads generated through content, such as form submissions or content downloads.

- Conversion Rates: Analyze how many leads from content marketing are converting into customers to assess the ROI of your content efforts.

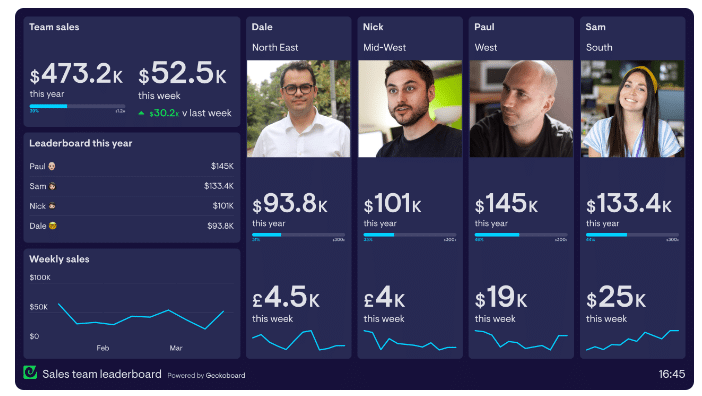

Want to get advanced? Have an office where people can see a TV screen? We do and we like to use a platform called Geckoboard. You can customize it to fit whatever you’d like to track and display it on a screen that gets updated in realtime!

Cross-Selling & Referral Strategies in Life Insurance

Techniques for Effective Cross-Selling

Cross-selling is an efficient strategy to increase sales by offering additional products to existing customers. This section focuses on techniques for effectively cross-selling life insurance with other products, providing agents with methods to maximize their sales opportunities. To maximize your cross-selling potential, consider these strategies:

- Bundling Products: Offer bundled packages combining life insurance with other insurance products, providing value and convenience to customers.

- Understanding Customer Profiles: Analyze customer data to identify other products they might need, such as health or disability insurance.

- Educational Approach: Educate customers about the benefits and importance of having multiple insurance policies, focusing on how they complement each other.

Building a Strong Referral Network

Referrals are a powerful source of high-quality leads. This part of the guide discusses strategies for building and maintaining a robust referral network, including tips on encouraging satisfied customers to refer friends and family. Developing a robust referral network can be achieved through these methods:

- Reward Programs for Referrals: Implement a reward system for customers who refer others, providing incentives for each successful referral.

- Maintaining Strong Relationships: Keep in regular contact with existing clients, ensuring satisfaction and keeping your services top of mind.

- Networking Events: Attend or host community events to expand your professional network and gain referrals.

Bonus Tip: Take a look at this tool called ReferralHero.com.

Encouraging Customer Referrals: Best Practices

Leveraging existing customers for referrals is a cost-effective way to generate new leads. This section offers best practices on how to motivate clients to refer their network, enhancing lead generation with a personal touch. Boost your referral rates with these best practices:

- Personalized Thank-You Notes: Send personalized thank-you messages to clients who make referrals, showing appreciation for their support.

- Referral Training for Clients: Educate your clients on how to provide referrals.

- Testimonials and Success Stories: Share testimonials and success stories with your clients, demonstrating the impact of your services and encouraging them to refer others.

Customer Relationship Management (CRM) in Lead Generation

Utilizing CRM for Effective Lead Management

CRM systems are essential for managing and nurturing leads. This section explores how to use CRM systems for lead nurturing and management, ensuring a systematic and efficient approach to tracking and following up with potential clients. Maximize your CRM’s potential with these strategies:

- Segmentation of Leads: Use CRM to categorize leads based on their interest level, demographics, or interaction history.

- Regular Data Updating: Keep lead information current in the CRM to ensure effective communication and personalization.

- Automated Lead Nurturing Workflows: Set up automated workflows in the CRM to send timely follow-ups and educational content to leads.

Best Practices for Lead Tracking and Follow-Up

Effective follow-up is key to converting leads into clients. This part of the guide delves into best practices for tracking and following up with leads, offering strategies to maintain engagement and move leads through the sales funnel. Ensure effective lead conversion with these follow-up strategies:

- Consistent Follow-Up Schedule: Establish a regular schedule for follow-up communications to keep leads engaged.

- Personalized Communication: Tailor follow-up messages based on the lead’s interests and previous interactions.

- Tracking and Analyzing Interactions: Use CRM to track all interactions and analyze responses to refine follow-up strategies.

Automation Tools for Streamlining Lead Generation

Automation can greatly enhance the efficiency of lead generation processes. This section examines various automation tools available and how they can be integrated into your lead generation and management workflow. Leverage automation tools for enhanced lead generation efficiency:

- Email Marketing Automation: Automate email campaigns to nurture leads based on their engagement level or stage in the buying process.

- Social Media Management Tools: Use tools for scheduling and analyzing social media posts to engage with leads across platforms.

- Lead Scoring Automation: Implement lead scoring systems to prioritize leads based on their likelihood to convert, focusing efforts where they are most likely to succeed.

Conversion Rate Optimization (CRO) for Life Insurance Websites

Turning Leads into Policyholders: Effective Strategies

Conversion rate optimization is crucial for transforming leads into actual sales. This section provides insights into strategies that can help increase the likelihood of leads becoming policyholders, such as optimizing web pages and calls to action.

A/B Testing for Landing Pages and CTAs

A/B testing is a powerful method to improve conversion rates. This part of the guide covers conducting A/B tests on landing pages and CTAs effectively, ensuring that your website elements are optimized for maximum conversion. Optimize your landing pages and CTAs with these A/B testing strategies:

- Test Different Headlines: Compare the performance of varying headlines to see which resonates more with your audience.

- CTA Button Color and Text: Experiment with different colors and texts for your CTA buttons to determine which combination leads to higher conversions.

- Layout Variations: Test different layouts for your landing page to find the most effective arrangement for user engagement and conversion rate.

Enhancing User Experience (UX) for Better Conversion

The website’s user experience can significantly impact conversion rates. This section offers UX best practices tailored for insurance websites, aiming to provide visitors a seamless and engaging experience, thereby boosting conversions. Create a user-friendly experience on your insurance website with these UX tips:

- Simplified Navigation: Design a straightforward and intuitive navigation structure that lets users find information quickly.

- Fast-Loading Pages: Ensure your web pages load quickly to reduce bounce rates and keep users engaged.

- Clear and Concise Content: Provide information in a clear, concise manner, making it easy for users to understand insurance concepts and offerings.

Networking and Community Involvement for Lead Generation

The Role of Networking in Generating Leads

Networking events and community involvement can be fruitful sources of leads. This section discusses the importance of these activities in lead generation and offers tips on making the most of networking opportunities. Expand your lead generation potential with effective networking:

- Professional Associations and Clubs: Join and actively participate in insurance and business-related associations to broaden your professional network.

- Leverage Online Networking Platforms: Use platforms like LinkedIn for virtual networking, connecting with other professionals and potential leads in the insurance sector.

- Offer Value in Networking: Share your expertise and insights at networking events to establish yourself as a knowledgeable resource in the insurance field.

Engaging with Local Communities for Leads

Engagement can be an effective way to generate leads. This part of the guide explores strategies for community involvement, such as participating in local events and forming partnerships with local businesses or organizations. Strengthen your local community connections to enhance lead generation:

- Sponsor Local Events: Act as a sponsor for local events, increasing your visibility and demonstrating your commitment to the community.

- Volunteering and Community Service: Participate in or organize community service activities, building relationships and goodwill within the local area.

- Educational Workshops and Seminars: Host or participate in educational events on insurance topics, providing value and increasing awareness of your services.

Forming Strategic Partnerships for Lead Generation

Partnerships can open up new avenues for lead generation. This section examines how forming strategic partnerships with other businesses or community organizations can help generate quality life insurance leads. Create mutually beneficial partnerships for effective lead generation:

- Collaborate with Local Businesses: Partner with businesses like real estate agencies or financial planners, where you can offer complementary services.

- Joint Marketing Initiatives: Engage in co-marketing efforts with your partners, such as joint seminars or cross-promotional campaigns.

The Role of Lead Aggregators in Insurance

Understanding Lead Aggregators in the Insurance Industry

Lead aggregators offer a significant avenue for insurance agents to acquire leads. Grasping these aggregators’ functions is essential for effectively integrating them into your lead-generation strategies. Lead aggregators play a crucial role in the landscape of insurance lead generation:

- Diverse Lead Sources: Understand that aggregators source leads from various channels, offering a broad spectrum of prospects.

- Quality Assessment: Assess the quality of leads provided by different aggregators, which can vary significantly.

- Integration with Sales Process: Evaluate how leads from aggregators can be integrated into your existing sales processes and CRM systems.

How to Vet and Choose the Right Lead Aggregator

Choosing the right lead aggregator is crucial for success. This part of the guide discusses the factors to consider when vetting and selecting a lead aggregator, ensuring that agents make informed decisions. Choosing an appropriate lead aggregator requires careful consideration:

- Reputation and Reliability: Research the aggregator’s reputation in the industry and its track record for reliability.

- Cost-Benefit Analysis: Conduct a thorough cost-benefit analysis to determine if the investment aligns with your expected return on leads.

- Compatibility with Your Niche: Ensure the aggregator specializes in or is well-versed with life insurance leads, as this impacts the relevance of leads.

Pros and Cons of Using Third-Party Leads

Using third-party leads has its advantages and drawbacks. This section delves into the pros and cons of using leads from lead aggregators, helping agents weigh their options and decide what’s best for their business.The decision to use third-party leads involves weighing both sides:

- Cost-Effectiveness: Third-party leads can be cost-effective, especially for agents looking to expand their reach quickly.

- Dependency Risks: Consider the risk of becoming dependent on external sources for leads, which might affect long-term lead generation sustainability.

Cold Insurance Leads: Utilization and Challenges

Understanding Cold Leads in Life Insurance

Cold leads, those with whom you have had no prior interaction, present unique challenges. This section provides a definition and overview of cold leads in the life insurance sector, preparing agents to approach these leads effectively. Cold leads in life insurance require a nuanced approach:

- Recognize Low Initial Interest: Acknowledge that cold leads typically have low initial interest or awareness about life insurance.

- Identify Potential Needs: Analyze demographic and psychographic data to identify potential insurance needs.

- Tailored Approach for Engagement: Develop a tailored approach to engage these leads, considering their unique position in the buyer’s journey.

Strategies for Warming Up Cold Leads

Transforming cold leads into potential clients requires specific strategies. This part of the guide covers various techniques for warming up cold leads, making them more receptive to life insurance offers. Effective techniques can turn cold leads into promising prospects:

- Educational Content Delivery: Share informative and educational content to build awareness and trust.

- Personalized Outreach: Use personalized communication to address their specific life stage and insurance needs.

- Follow-Up Consistency: Maintain consistent follow-ups to warm up the leads, using various communication channels gradually.

Effective Use of Cold Leads in Lead Generation

While challenging, cold leads can be valuable if used correctly. This section discusses when and how to use cold leads effectively, maximizing the chances of conversion. Cold leads can be a hidden gem when approached correctly:

- Strategic Timing: Identify optimal times for contact, such as during major life events.

- Combination with Warm Lead Strategies: Combine cold lead strategies with warm lead tactics for a balanced lead generation approach.

- Monitoring and Analysis: Regularly monitor the response of cold leads and analyze their behavior to refine your approach and improve engagement.

Cold Calling: Techniques and Scripts

Mastering the Art of Cold Calling

In the competitive world of life insurance, cold calling is a crucial technique for lead generation. It’s not just about making calls; it’s about making connections and understanding the unique needs of potential clients. Effective cold calling can turn a prospect into a lead and a lead into a customer. Here are some key strategies to master this essential skill:

- Pre-Call Research: Gather information about the lead to personalize the call.

- Develop a Strong Opening Statement: Craft an opening that grabs attention and clearly states the purpose of the call.

- Active Listening: Pay close attention to the prospect’s responses and adjust your pitch accordingly.

Life Insurance Cold Call Script Templates

Having a well-crafted script is like having a roadmap in the complex journey of cold calling. A good script helps navigate the conversation while addressing each client’s unique needs. It allows agents to present themselves professionally and communicate key points. Below are templates to guide life insurance agents in their cold calling endeavors:

- Introduction Script: A script that introduces you and your agency, highlighting your expertise in life insurance.

- Needs Assessment Script: Questions to understand the prospect’s insurance needs and concerns.

- Closing Script: Techniques to conclude the call effectively, either by setting an appointment or leaving the door open for future communication.

Measuring and Enhancing Cold Call Success

Measuring the success of cold-calling efforts is a pivotal step in enhancing lead generation effectiveness in life insurance. By analyzing call performance, agents can identify what works and what doesn’t, leading to improved strategies and conversion rates. Here are key metrics and strategies for evaluating and enhancing cold call success:

- Call Duration and Engagement Metrics: Track the average duration of calls and note when prospects tend to disengage.

- Conversion Rate Tracking: Monitor the ratio of calls made to leads generated or appointments set.

- Feedback and Adjustment: Regularly solicit feedback from prospects and colleagues, using this information to tweak your approach and script.

Less Effective Lead Generation Methods: What to Avoid

Identifying Less Effective Lead Generation Techniques

In the dynamic field of life insurance, not every lead generation method stands the test of time. Some strategies may become less effective as market trends and consumer behaviors evolve. Recognizing these can save time and resources, allowing agents to focus on more impactful techniques. This list highlights methods that might need reevaluation:

- Over-Reliance on Cold Calling: Excessive focus on cold calling without integrating other digital strategies.

- Generic Mass Email Campaigns: Undifferentiated, blanket email campaigns that fail to address specific customer needs.

- Neglecting Social Media Engagement: Underestimating the power of social media platforms for targeted lead generation.

Potential Pitfalls in Life Insurance Lead Generation

Navigating the life insurance market requires a keen understanding of what not to do, as much as what to do. Certain missteps can lead to inefficient use of resources and missed opportunities. Awareness of these pitfalls helps refine lead generation strategies for better outcomes:

- Ignoring Customer Feedback: Not leveraging customer feedback to improve services and lead generation tactics.

- Lack of Follow-Up: Inadequate follow-up with leads, leading to missed opportunities for conversion.

- Not Keeping Up with Industry Changes: Failing to stay updated with the latest trends and regulatory changes in the life insurance industry.

Advanced Lead Scoring and Qualification Techniques

Mastering Lead Scoring for Prioritizing Follow-Up

Lead Scoring isn’t just a tactic; it’s an art that, when mastered, can significantly streamline your lead management process. By assigning values to leads based on their engagement and relevance, you can effectively prioritize your follow-up efforts, focusing on those most likely to convert. This systematic approach ensures that your time and resources are invested wisely. Here’s how to master lead scoring:

- Engagement Level Analysis: Score leads based on their interactions with your content, emails, or social media.

- Demographic Scoring: Assign scores based on how closely leads match your ideal customer profile.

- Behavioral Indicators: Use website activity, such as page visits or download history, to score leads.

Criteria for Qualifying High-Potential Leads

In the quest for quality over quantity, knowing how to pinpoint high-potential leads is crucial. This process involves more than just gut feeling; it requires a strategic approach to evaluate each lead’s potential value. By setting clear criteria, you can efficiently sift through the noise and focus on those leads that are more likely to journey from prospects to loyal customers. Consider these criteria for identifying high-potential leads:

- Intent Signals: Look for signals of buying intent, such as repeated visits to pricing pages or requests for product demos.

- Fit with Product Offering: Assess how well the lead’s needs align with your life insurance products.

- Past Interactions and Responsiveness: Evaluate the lead’s history of interactions and their responsiveness to previous communications.

Embracing Technology and Innovation in Lead Generation

The insurance sector is riding a wave of technological innovation, transforming how agents generate and handle leads. Emerging technologies like AI, chatbots, and advanced analytics aren’t just buzzwords; they’re revolutionizing the approach to lead generation, offering smarter and more efficient methods. Embracing these technologies can give agents a significant edge. Here’s how:

- Artificial Intelligence (AI): Utilizing AI for predictive analytics and customer behavior modeling.

- Chatbots: Implementing chatbots for 24/7 customer engagement and preliminary lead qualification.

- Advanced Data Analytics: Leveraging big data to gain deeper insights into market trends and customer preferences.

Innovations Impacting Lead Acquisition in Insurance

In an industry as dynamic as insurance, staying updated with the latest innovations is not optional but necessary to remain competitive. Recent advancements are enhancing the efficiency of processes and opening new avenues for lead acquisition. By staying informed about these innovations, agents can position themselves at the forefront of the industry. Key innovations to watch include:

- Blockchain Technology: Exploring blockchain for enhanced data security and customer trust.

- Internet of Things (IoT): Leveraging IoT devices for personalized insurance solutions and proactive customer engagement.

- Mobile Applications: Utilizing mobile apps for direct engagement and tailored lead nurturing campaigns.

Multichannel Approach to Life Insurance Lead Generation

In today’s digital era, a balanced mix of online and offline strategies is key to a holistic lead generation approach. This strategy ensures you’re not putting all your eggs in one basket but capitalizing on both realms’ strengths. Agents can create a more robust and comprehensive lead generation plan by weaving together the digital prowess and the tangible impact of offline methods. Here are ways to effectively combine these channels:

- Digital Outreach and In-Person Follow-Up: Use online platforms for initial outreach, followed by in-person meetings or phone calls for a more personalized touch.

- Leverage Social Media with Direct Mail: Complement social media campaigns with targeted direct mail to reinforce your message.

- Host Webinars and Local Events: Combine the reach of online webinars with the personal touch of local events and seminars.

The Role of Omnichannel Marketing in Lead Generation

Omnichannel marketing is not just a strategy; it’s a holistic approach that aligns and unifies various marketing channels to offer a seamless customer experience. In life insurance, where trust and credibility are paramount, providing a consistent experience across all platforms can significantly enhance lead generation and conversion efforts. Omnichannel marketing plays a crucial role:

- Consistent Brand Messaging Across Channels: Ensure your brand message is coherent and aligned, whether on social media, email, or print materials.

- Integrated Customer Journeys: Design customer journeys that smoothly transition between online and offline touchpoints.

- Data-driven insights for Personalization: Utilize data from various channels to tailor interactions and offers to individual client needs.

Training and Development for Lead Generation Teams

The Importance of Continuous Training in Lead Generation

Continuous training is not just about keeping up; it’s about staying ahead in the competitive world of insurance lead generation. This commitment to ongoing education ensures that your team is equipped with the latest techniques and insights, enabling them to adapt and thrive in a rapidly changing environment. Here are ways to implement continuous training:

- Regular Workshops and Seminars: Host or attend workshops focusing on new lead generation techniques and tools.

- Online Courses and Webinars: Encourage team members to participate in relevant online courses and webinars.

- Peer-to-Peer Learning Sessions: Facilitate regular knowledge-sharing sessions within the team to discuss new ideas and experiences.

Staying Current with Insurance Industry Certifications and Education

In the dynamic landscape of the insurance industry, staying current with certifications and ongoing education is not just beneficial – it’s essential. It ensures that agents and brokers are compliant with industry standards and well-informed about the latest trends and practices. This knowledge is invaluable in maintaining credibility and effectiveness in lead generation. Here’s how to stay updated:

- Regular Certification Renewals: Keep track of certification renewals and participate in required continuing education.

- Industry Conferences and Events: Attend industry conferences and events to learn about new developments and network with peers.

- Subscription to Industry Publications: Stay informed by subscribing to key industry publications and online resources.

Building a Strong Brand for Effective Lead Generation

Developing a Strong Brand Identity in the Insurance Market

Creating a strong brand identity in the insurance sector is more than just a logo or a catchy tagline; it’s about connecting with your audience. A well-defined brand can differentiate your services in a saturated market, creating a lasting impression on potential clients. To develop this identity, consider the following:

- Define Your Unique Value Proposition: Clearly articulate what sets your insurance services apart from competitors.

- Consistent Visual Branding: Use consistent colors, logos, and design elements across all marketing materials.

- Engaging Brand Story: Craft a compelling brand story that resonates with your target audience and reflects your company’s values and mission.

Effective Brand Messaging and Positioning Strategies

Brand messaging and positioning in the insurance market are crucial for attracting and retaining leads. It’s about communicating your value in a way that speaks directly to your target audience’s needs and preferences. Effective brand messaging can build trust and establish your brand as a go-to source in the insurance industry. Here are strategies to achieve this:

- Target Audience Analysis: Understand the needs, preferences, and pain points.

- Clear and Consistent Messaging: Ensure your brand message is clear, consistent, and effectively communicated across all channels.

- Strategic Positioning: Position your brand in a way that highlights your strengths and differentiates you from competitors.

Leveraging Testimonials and Case Studies in Insurance Marketing

Incorporating Customer Success Stories in Marketing

Using customer success stories in marketing isn’t just about showcasing achievements; it’s about humanizing your brand and making a genuine connection with your audience. These stories provide tangible proof of your service’s value, resonating deeply with potential clients. When utilized effectively, they can transform your marketing strategy. Here’s how to incorporate these stories:

- Video Testimonials: Create engaging video testimonials that bring client stories to life.

- Case Studies on Your Website: Feature detailed case studies on your website, highlighting how your services have positively impacted clients.

- Social Media Sharing: Share success stories on social media platforms, increasing reach and engagement.

The Impact of Testimonials on Trust and Credibility

In insurance, where decisions are driven by trust, testimonials are a goldmine. They act as social proof, endorsing your services and reassuring potential clients of their effectiveness. When used strategically, testimonials can be a game-changer in your marketing approach, enhancing trust and credibility. Consider these methods to leverage testimonials:

- Featured Quotes in Marketing Materials: Use impactful client quotes in your brochures and email campaigns.

- Testimonial Page on Website: Dedicate a section of your website to client testimonials and success stories.

- Incorporate in Sales Pitches: Use testimonials as part of your sales presentations to build confidence in your offerings.

Utilizing Feedback to Refine Lead Generation Strategies

Feedback is a goldmine of insights, serving as a direct line to your customers’ thoughts and experiences. It’s an essential component for fine-tuning your lead generation tactics. Actively seeking and applying feedback ensures that your strategies are aligned with customer needs and market demands. Here’s how to leverage feedback effectively:

- Surveys and Questionnaires: Regularly conduct surveys to gather opinions and suggestions from leads and customers.

- Feedback Forms on Website: Implement feedback forms on your website for easy customer input.

- Review Meetings with Sales Team: Hold regular meetings with your sales team to discuss feedback and its implications on your strategies.

Implementing Continuous Improvement Practices

In the fast-paced world of lead generation, resting on your laurels is not an option. Adopting continuous improvement practices is crucial for ensuring your strategies stay ahead of the curve. This approach involves regularly evaluating and updating your tactics to meet evolving market needs. Here are methods to embed continuous improvement into your lead generation process:

- Regular Strategy Audits: Periodically audit your lead generation strategies to identify areas for improvement.

- Up-to-date Training: Ensure your team is continuously trained on the latest tools and techniques.

- Incorporate Latest Market Trends: Stay informed about market trends and adjust your strategies to capitalize on new opportunities.

Crafting Your Personalized Life Insurance Lead Generation Plan

Understanding your unique strengths and resources is the first step in crafting an effective lead generation strategy. Each insurance agency varies in its approach, influenced by its business model, team capabilities, and available tools. This assessment helps pinpoint which strategies will be most effective for your specific situation:

- Analyze Your Business Model: Understand the specifics of your insurance offerings and how they fit into the market.

- Assess Team Skills: Evaluate your team’s strengths and skill sets to determine how they can best contribute to lead generation.

- Review Available Tools and Technologies: Take stock of the tools and technology at your disposal, including CRM systems and marketing platforms.

Developing a Tailored Lead Generation Strategy

Creating a lead generation strategy that aligns with your agency’s specific needs is not just a part of the process; it’s the crux of effective marketing. This tailored strategy should reflect your agency’s unique position in the market, making the most of your resources and target audience. Here’s how to develop this strategy:

- Set Specific Goals and Objectives: Clearly define what you aim to achieve with your lead generation efforts.

- Select Suitable Channels: Choose lead generation channels most likely to reach and resonate with your target market.

- Create a Scalable Plan: Ensure your strategy is adaptable and can grow with your business.

Compliance and Ethical Considerations in Lead Generation

Understanding the legal framework governing life insurance lead generation is crucial. This section provides insights into the legal aspects, ensuring that agents are well-informed about the regulations and laws affecting their lead generation practices. Navigating Legal Aspects of Life Insurance Lead Generation

- Regularly Update Knowledge of Laws: Stay informed about federal, state, and local laws that govern life insurance lead generation, as they are regularly updated.

- Consult Legal Experts: Seek advice from legal professionals specializing in insurance law to ensure compliance in all practices.

- Training and Workshops: Participate in training sessions and workshops to stay current with legal requirements in the insurance industry.

Maintaining Ethical Standards in Pursuit of Leads

Ethics play a pivotal role in the insurance industry. Maintaining high ethical standards in lead generation is not just important; it’s essential. It’s crucial to ensure that your practices are effective and adhere to the highest moral principles. This approach safeguards your reputation and builds lasting trust with clients.

- Transparent Communication: Always be transparent with potential clients about your services and the terms of insurance policies.

- Avoid Misleading Practices: Steer clear of any marketing or sales tactics that could be considered misleading or unethical.

- Regular Ethics Training: Engage in regular ethics training to reinforce the importance of ethical practices in lead generation.

Privacy Laws and Regulations in Customer Information Handling

In the insurance industry, managing customer information is a delicate balance between accessibility and privacy. Adhering to laws and regulations governing data handling is paramount. This involves understanding various privacy laws, ensuring secure storage and processing of customer data, and being transparent about data usage.

- Adhere to Privacy Policies: Comply with privacy laws and regulations, especially when handling sensitive customer information.

- Secure Data Handling: Implement secure systems and processes for storing and managing customer data.

- Stay Informed on Privacy Law Changes: Keep abreast of changes in privacy laws to ensure that your data handling practices remain compliant.

Key Takeaways and Final Thoughts for Life Insurance Agents

As you refine your lead generation strategies in life insurance, remember these key takeaways:

- Embrace a Multichannel Approach: Combining online and offline strategies ensures a broader reach and more robust engagement.

- Leverage Technology and Innovations: Utilize emerging technologies like AI and analytics to stay ahead.

- Focus on Continuous Learning: Keep evolving through regular training and staying updated with industry trends.

- Personalize Your Strategies: Tailor your approaches to resonate with your unique market and leverage your agency’s strengths.

Conclusion

The journey of mastering life insurance lead generation is ongoing. It’s a field that rewards persistence, innovation, and adaptability. Stay curious, be open to new methods, and continuously refine your strategies. Remember, each interaction is an opportunity to learn and improve. You can turn challenges into stepping stones for success with the right approach and mindset. Keep pushing forward, stay committed to your goals, and the results will follow. You’ve got this!

Ready to buy leads? Click here to see our English and Spanish packages.