![The Ultimate Guide To Buying Aged Insurance Leads [2023]](https://badassinsuranceleads.com/wp-content/uploads/2023/01/elderly-couple-lead-generation.jpg)

The Ultimate Guide to Buying Aged Insurance Leads [2023]

There are a many aged lead vendors out there. This guide will help you make the best decision when purchasing aged leads for yourself, agents, brokers or call center.

What is an Aged Insurance Lead?

Aged life insurance leads are those who have previously expressed interest in buying life insurance and have provided their contact information via an online form or phone call. Name, contact information (phone, email, etc.), and other pertinent information may be included.

Aged leads are frequently sold to other insurance agents or brokers that want to increase their clientele by the original lead generation organization. Aged leads are typically several months or even years old.

A valuable source for insurance brokers and agents, aged leads are people who have already expressed interest in buying life insurance. However, it’s crucial to remember that it might take more work to turn these leads into paying customers because they might not be as receptive or new as leads from more recent sources.

Types of Aged Insurance Leads

There are many types offered by multiple sources. Some of the most popular insurance lead verticals are:

- General Life & Final Expense Insurance

- Mortgage Insurance

- Health Insurance

- Medicare Insurance Leads

Why Should I Consider Using Aged Insurance Leads?

Utilizing second chance or aged leads may be an efficient method for insurance agents and brokers to boost their customer base and revenues. The life insurance sector can benefit from older leads for the following reasons:

Because they are older and perhaps less receptive, aged leads are often offered lower prices than their younger counterparts. This may be an efficient method for insurance agents and brokers to obtain new clients.

While older leads may be less receptive, they may be further along in the buying decision process and closer to completing the transaction. This can increase their likelihood of becoming paying clients.

Aged leads can assist in filling gaps in the sales funnel. For example, insurance agents and brokers frequently experience sales fluctuations. They may only sometimes have a continuous flow of fresh leads. Using older leads can assist in covering these gaps and maintaining a steady sales funnel.

Using older leads may also be an efficient approach for insurance agents and brokers to develop their customer base long term, so long as they can market to and nurture the leads successfully.

Lead Quality Checks

The quality of the leads should be taken into account while purchasing aged life insurance leads. This covers elements like the relevancy and responsiveness of the leads and the quality and completeness of the personal information given.

The following specific factors should be taken into account while assessing the caliber of old life insurance leads:

Verify that the lead-generating company has confirmed the correctness of any personal information you have supplied, including your name, phone number, and email address. Inaccurate or out-of-date information can be a time and money waste. (You can also ask if the leads were captured in a TCPA compliant fashion.)

Relevance of the leads: Consider how well your target market and product offers to match the leads. It’s critical to have leads who are ready to buy life insurance and are interested in doing so.

Lead responsiveness: Consider if the leads have previously shown a desire to buy life insurance and whether they have reacted to prior outreach attempts. You may determine their degree of interest and are likely to convert based on this.

How Many Leads Should You Buy

When assessing the number of aged life insurance leads, keep the following in mind:

How many leads are necessary to achieve your sales objectives? Make sure you have enough leads to sustain your targeted degree of development and take into account how many leads you must convert in order to fulfill your sales goals.

Can you follow up with a lot of leads efficiently? Remember that following up with additional leads can necessitate more time and resources. Make sure you have the ability to nurture and convert these leads efficiently.

Do you feel like you’re getting your money’s worth? Take into account the leads’ price in relation to the number of them being acquired. If you are purchasing a higher volume, you might be able to bargain for a cheaper price per lead.

You can make sure you have enough leads to fulfill your sales goals while also keeping in mind your capacity to follow up with and convert these leads by carefully assessing the number of leads that are purchased.

Cost of Aged Insurance Leads

You can expect to pay anywhere from 0.10 – $3.00 per aged lead. However, there are many factors that determine the cost. Factors such as:

- The lead generation method used to generate.

- The source or seller.

- The age of the lead.

- The data validation methods.

- The quantity you buy.

Where to Buy Aged Insurance Leads

Marketing Agencies or Lead Generation Companies

Agencies that generate and sell leads to businesses in various industries, including the life insurance market, are known as lead generation companies. These businesses often employ multiple strategies to attract potential life insurance customers, such as internet advertising and social media marketing. These businesses then sell the leads they have created to insurance brokers and agents who want to increase their clientele. On the aged lead front, they sometimes then sell their old leads as aged leads to agents and brokers as well.

Using lead-generating businesses to obtain aged life insurance leads has various benefits:

Convenience: Lead-generating businesses can easily access many leads, frequently with the choice to buy leads in bulk or in real-time.

Skill: Lead generation businesses frequently have experience and expertise in producing leads in particular sectors, and as a result, they may be able to offer leads of higher quality.

Using focused marketing strategies, lead generation firms may draw leads that are more pertinent to their target markets and product offers.

Before buying leads from a lead-generating company, it is crucial to conduct thorough research on and evaluate the company. Seek out businesses with a solid reputation and a track record of producing leads of the highest caliber. Additionally, you should request case studies or references from other insurance brokers or agents who have used the company’s leads.

Online Marketplaces

Aged life insurance leads can be purchased on online stores called “online marketplaces”. These marketplaces can give insurance agents and brokers easy access to many leads, frequently at a lower price than buying leads directly from a lead-generating firm.

When using internet marketplaces to buy aged life insurance leads, keep the following in mind:

The accuracy and completeness of the personal information given. More specifically, you should be aware of where the leads have come from originally and find out if the leads are appended to for accuracy.

The seller’s reputation: Select vendors with a solid standing and a history of delivering top-notch aged leads. Additionally, you should request case studies or references from other insurance brokers or agents who have bought leads from the vendor.

Review the conditions of the sale, including any warranties or guarantees provided by the seller, carefully. Ensure you are aware of the hazards and the services you purchase.

Using internet marketplaces to get second chance life insurance leads can be practical and cost-effective.

Aged Lead Conversion Rate Calculation

The percentage of leads that are successfully turned into paying customers is known as the conversion rate. This indicator can help assess the performance of elderly life insurance leads because it provides information on how well the leads are doing.

The conversion rate for older life insurance leads can be determined in a few different ways:

100 divided by the number of leads converted from the total leads.

Your conversion rate would be 20%, for instance, if you had 100 aged life insurance prospects and successfully turned 20 into paying clients.

Revenue from leads that were converted / 100 times the cost of the leads.

You may get a feel of the lead investment return using this calculator. Your conversion rate would be 1,000%, for instance, if you bought $1,000 for 100 aged life insurance leads and could make $10,000 in profit from converted leads.

You can gauge how well your elderly life insurance leads are functioning and make adjustments to increase the conversion rate by monitoring the leads’ conversion rates.

Tips for Successful Prospecting

You can improve your chances of success while employing senior life insurance leads by following these suggestions:

Personalize your outreach: Many insurance agents and brokers may have previously contacted older leads, so it’s critical to stand out. Personalize your communication and strategy to demonstrate that you care about addressing their particular requirements and issues.

Follow up frequently: Older leads might not be as receptive as newer ones, so frequent follow-up is necessary to maintain their interest. This may entail contacting them via several platforms, including phone, email, and social media.

Use lead nurturing strategies to develop relationships with leads over time through individualized and pertinent communication. Assist the lead in making a wise choice; this can involve offering insightful content, such as instructive articles or films.

You may improve your odds of converting senior life insurance prospects into paying clients by tailoring your approach, following up consistently, and implementing lead nurturing techniques.

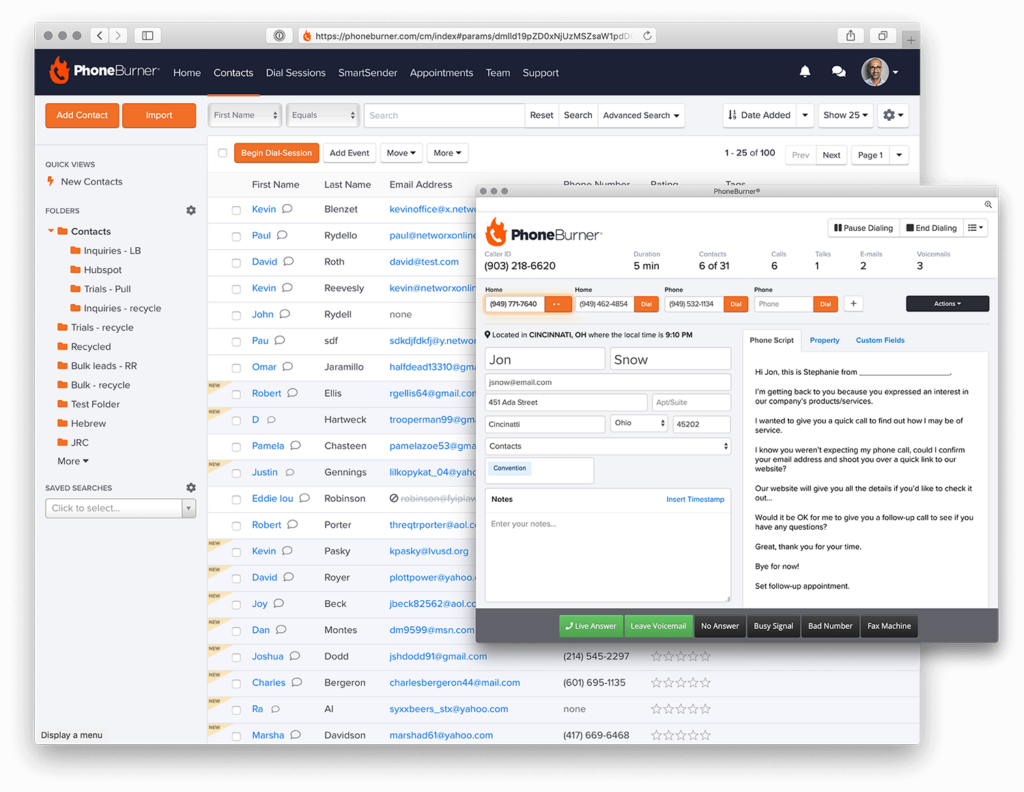

Should I use a Phone Dialer System?

We recommend using a dialer software to help you manage calls. They are especially useful when buying aged leads because you’ll most likely have hundreds of leads and calls to go through. One of our favorite dialers is one called PhoneBurner but there are dozens of others as well.

Conclusion

In conclusion, aged life insurance leads can be a helpful tool for insurance brokers and agents looking to grow their clientele and revenue. To make sure that you are getting good value for your money, it is crucial to carefully consider the quality, quantity, cost, and source of the leads. To improve your chances of success, employ measures like tailoring your outreach, following up consistently, and using lead nurturing techniques. It’s also vital to track the conversion rate of the leads to get a feel of how effective they are. You can effectively employ elderly life insurance leads to expand your company by adhering to these best practices.