What Are Aged Life Insurance Leads?

As a life insurance broker or agent, you’re faced with a sea of options when it comes to purchasing leads. You might have heard that aged leads are a cost-effective way to acquire potential customers, but are aged life insurance leads worth it?

Let’s break down what aged leads are, how much they cost, and why they’re great for life insurance brokers.

What Does Aged Mean?

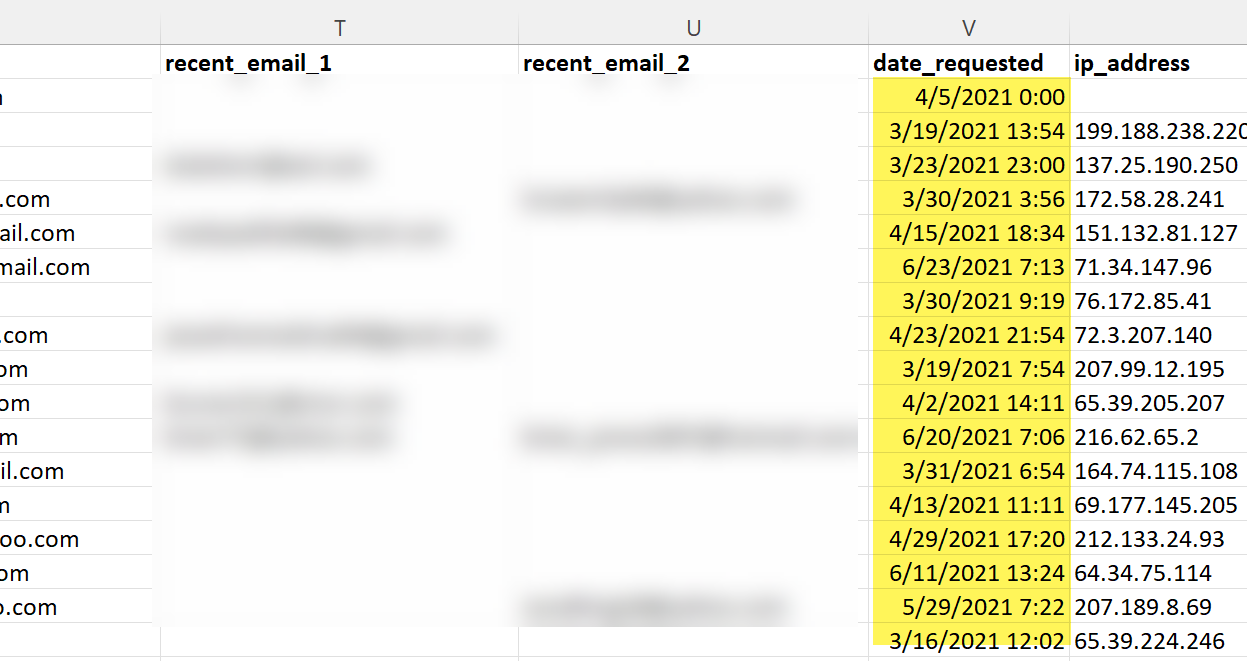

An “aged lead” is a lead that’s at least a couple of weeks old but can be anywhere from 30 days to several months or a year old. This is in contrast to “real-time” or “fresh” leads, which are only a few minutes or days old at most.

Generally, the older the lead is, the cheaper it will be. This is why many agents prefer working with aged life insurance leads — with a lower initial investment on lead purchases, it’s hard to beat the ROI of aged leads.

Aged leads and fresh leads are generated in the same ways, but they can vary in quality. Fresh leads are generally regarded as better quality because they haven’t yet been contacted by another broker.

Some agents find aged leads harder to work with for a few reasons. A lot of the time, these older leads have already been contacted by an agent who wasn’t able to convert them. The lead may have lost interest or found another policy in the time between when they opted in and when you contact them.

Despite the challenges of aged leads, many life insurance agents prefer working with them due to the low cost and high ROI.

How Much Do Aged Life Insurance Leads Cost?

One of the major benefits of aged life insurance leads is their affordable price tag. You can often find aged life insurance leads for anywhere from .02 cents to around $1.00 per lead. The lower cost of aged life insurance leads means that agents can acquire large amounts of aged leads for a fraction of the cost of buying fresh leads.

When it comes down to it, working aged leads is a numbers game. Conversions tend to be lower than fresh leads, but the dirt-cheap cost of aged leads allows you to scale up your operation to get the results you want.

For example, if you purchased a pack of 1,000 leads for $500 (50 cents per lead). With the average conversion rate of aged leads sitting at about 0.4%, you can expect to get about 4 applications out of that batch of leads.

Now let’s say you took that $500 and bought fresh leads instead. Considering that fresh leads go for an average price of $25 per lead, you’d end up with just 20 leads. Even factoring in the higher conversion rate of fresh leads, most brokers would have a difficult time getting 4 or more applications out of only 20 leads.

When you’re working with a tight budget, it can make a lot of sense to purchase aged leads in bulk rather than invest in significantly fewer fresh leads for the same price. In the end, you may find more success simply by having a much bigger pile of leads to work.

Aged life insurance leads work great as a “business builder” for new agents. When you’re just starting out, you need to build a robust pool of leads without breaking the bank. Purchasing aged leads in bulk can help get you there.

Where can I buy Aged Life Leads?

Of course, we’d like you to use Dirt Cheap Life Leads for your #1 source, but after working with 1000s of agents over the years, we know that lead buying diversification is important. Here are some aged lead vendors that sell aged life leads that we have vetted:

**Remember! There’s no “magic” lead or lead source. See our recent video and post here. **

Do Aged Leads Work specifically for life insurance?

Some insurance agents turn up their nose at the very thought of using aged leads because they’ve heard that these leads are harder to work with. But the life insurance industry is actually uniquely suited to converting aged leads.

Life insurance is a rare product that consumers are, or at least should be, always in the market for. It’s something everyone needs, and savvy shoppers are always looking for a better price.

Additionally, insurance needs can change throughout someone’s life. Even if the lead is only a few months old, that potential customer might have had a change in income, raised their credit score, or expanded their family since they talked to the first broker. They may have also been undersold by the selling agent! Chances are, these leads are willing to get an updated quote, moving them further into the sales funnel and closer to a conversion.

Just because a lead is aged doesn’t mean it’s bad, either. Plenty of perfectly good leads end up in the “aged” pile simply because brokers don’t see success after the first call.

Selling life insurance isn’t a one-and-done process. Choosing a life insurance policy is a big decision, and most leads will want to have a few conversations with a broker before they finally pull the trigger.

With determination, patience, and the ability to build trust with your potential customers, you can find great success with aged life insurance leads.

Ready to give aged life insurance leads a try? Order quality, cost-effective leads from Dirt Cheap Life Leads here.

Learn about our telesales insurance leads packages here.

Download our Aged Life Insurance Leads Script for Free HERE.