Crafting the Perfect Email Template for Aged Life Insurance Leads

Are you looking for an effective email template to reach out to aged life insurance leads? With some helpful tips and techniques you can form effective insurance email marketing that will draw in your desired demographic.

In this post we’ll discuss how to craft an email template for aged life insurance leads that is both persuasive and informative, highlighting key benefits while also providing a clear call-to-action. Let’s dive in.

Identify Your Target Audience

When email marketing, the key is to recognize who your message will be directed at. Also known as a target persona, knowing who you are sending emails to will help you craft an engaging subject line and personalize your message. It’s also essential for highlighting benefits that matter most to the recipients.

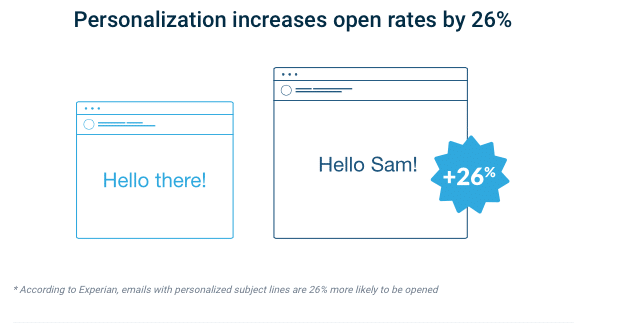

Personalizing emails is another effective strategy when targeting prospective families or individuals that would be open to buying life or health insurance. (Note: Most common email marketing software can do this).

Since these are most likely semi-cold emails, using customer data such as their name or company name in the subject line or body of an email can make a huge difference in terms of engagement rates compared to generic “Dear Sir/Madam” style salutations at the start of each message sent out en masse.

Highlighting the benefits that are relevant to this particular target audience is paramount; potential insurance customers need to be aware of what advantages they will gain from utilizing your product or service before taking the plunge – especially since these are AGED leads and have most likely been engaged with over the past 1 – 12 months.

Showcasing success stories from existing clients who have reaped rewards by utilizing your insurance products can help sway those still undecided into investing in these types of services, as hearing first-hand accounts makes things feel more tangible than just reading through facts and figures.

Key Takeaways: Targeting insurance agents and brokers with aged leads can be done effectively by personalizing emails, highlighting the relevant benefits of using your product or service, and showing success stories from existing clients.

Craft an Engaging Subject Line

Strategic email marketing campaigns are a powerful tool for insurance agents and brokers. Crafting an engaging subject line can help capture the attention of potential customers, as well as increase open rates. To create effective email campaigns that generate leads, here are some tips to consider when writing your subject lines:

1. Keep it succinct: Make sure your subject line doesn’t exceed 50 characters. This will ensure that the full message is visible on mobile devices, increasing visibility and click-throughs.

Make sure to include keywords related to life insurance in your subject line, so that potential customers know exactly what they can expect before clicking through on your message. Especially since they didn’t buy the first time they were a “fresh lead”.

2. Don’t Use Emojis: A recent study showed that adding emojis into your subject like, believe it or not, doesn’t improve open rates.

3. Be creative: Think outside of the box when crafting your subject lines. Try using humor or clever wordplay to grab people’s attention and entice them into opening up your email messages instead of leaving them unopened in their inboxes forevermore. Check out some creative subject lines here.

Get creative with wordplay and humor for maximum impact – this is the perfect opportunity to stand out from the rest of their inbox clutter. Be direct and succinct – keep it short and sweet (50 characters or less) so that the full message is visible on mobile devices.

4: Include incentives: Give readers something extra by including special offers or discounts within your subject lines; this could be anything from free templates for creating follow-up emails, discounts on auto insurance premiums, etc., depending on what kind of services/products you offer. This can help to increase engagement rates and entice potential customers into opening up your email messages instead of leaving them unopened in their inboxes forevermore.

List Segmentation

Another way to personalize emails is by segmenting lists based on different criteria such as age group, gender, location etc., so that each person receives content tailored specifically for them.

For example if you’re targeting retirement planning services towards people over 50 years old then it makes sense not to send emails about insurance policies that would only be applicable for younger individuals.

Some additional email list segmentation ideas for aged data include:

- By inquiry date

- Type of policy

- Open or clickthrough rate

- Original source of lead

- Buyer persona

- Birthdates

Include a Call-to-Action

In an email campaign, a critical factor is having a compelling call-to-action (CTA) that prompts the reader to act. This is the part of your message that encourages recipients to take action on your offer. A CTA should be clear and concise so that readers know exactly what you want them to do.

Your CTA should stand out from the rest of your message by using larger font sizes or bold text. Since these are aged leads, you may want to use language that will motivate people to act such as “Sign up now” or “Take advantage today.”

You can also create urgency in your CTAs by including time limits such as “Get 20% off until Friday” or “Free shipping for orders placed before midnight tonight.” These types of CTAs are more likely to get people’s attention and encourage them to take action quickly.

Finally, make sure you provide easy access links within your CTA so that customers don’t have to search around for information. Include a few distinct links in various places of your communication, so customers don’t have to scour the message for what they need. This helps ensure maximum engagement with your email campaigns and ultimately leads to more conversions

Conclusion

When it comes to writing an email template for aged life insurance leads, the key is to be creative and engaging. Identify your intended recipients, come up with an engaging headline, personalize the communication to their requirements and preferences, emphasize advantages of partnering with you as a broker or agent, and include a direct call-to-action that motivates them to take the next step in connecting with you. With these tips in mind, crafting effective emails should become easier.